Introduction to Life Insurance

Life insurance is a financial tool that provides protection and security to individuals and their families. It offers a payout to beneficiaries upon the insured person's death, which can help cover expenses, replace lost income, and ensure financial stability. Life insurance is an essential component of a comprehensive financial plan, providing peace of mind and financial support for the future.

A. What is life insurance and how does it work?

Life insurance is a financial tool that provides protection and security to individuals and their families. It offers a payout to beneficiaries upon the insured person's death. The policyholder pays regular premiums to the insurance company, who then invests and manages the funds. In the event of the insured person's death, the beneficiaries receive the death benefit payout, which can help cover expenses and replace lost income. Life insurance policies can come in various forms, such as term life insurance and permanent life insurance, offering different coverage durations and benefits.

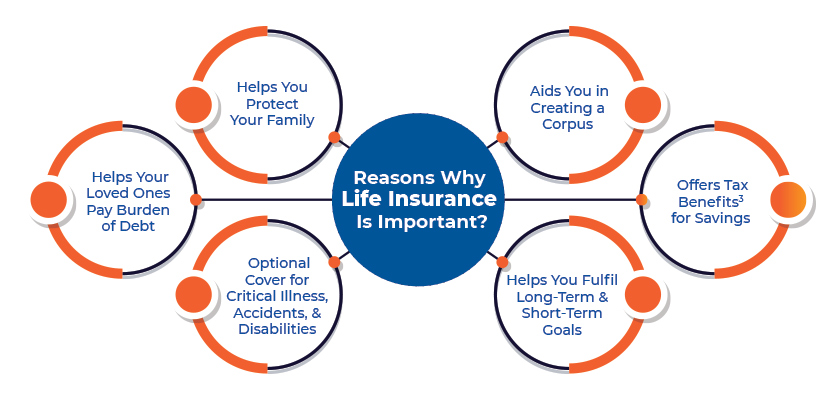

B. Importance of having life insurance coverage

Having life insurance coverage is vital for individuals and families. It provides financial security and protection in the event of the insured person's death. Life insurance ensures that loved ones are taken care of, offers income replacement, helps pay off debts, assists with estate planning, and provides peace of mind for future planning. It is a responsible and prudent step towards safeguarding the financial well-being of your loved ones.

Financial Security and Protection

Financial security and protection are crucial aspects of having life insurance coverage. In the event of the insured person's death, life insurance ensures that loved ones are taken care of financially. It provides a lump sum payout or regular income to help cover living expenses, education costs, and other needs. This financial support offers a sense of security and stability during a difficult time. Life insurance also provides protection against unexpected expenses or liabilities, such as medical bills or outstanding debts. This ensures that your loved ones are not burdened with financial obligations after you're gone.

A. Providing financial security for your loved ones

Life insurance provides financial security for your loved ones by ensuring that they are taken care of financially in the event of your death. This includes providing a lump sum payout or regular income to help cover living expenses, education costs, and other needs. This support offers a sense of security and stability during a difficult time.

B. Protection against unexpected expenses or liabilities

Life insurance also provides protection against unexpected expenses or liabilities that may arise after your passing. It can help cover medical bills, funeral expenses, and any outstanding debts or loans you may have. This ensures that your loved ones are not burdened with these financial obligations during an already difficult time.

Income Replacement and Support

Life insurance provides essential income replacement for your beneficiaries in the event of your passing. It ensures that your loved ones can maintain their standard of living and meet ongoing financial obligations. This support is particularly crucial for family members and dependents who rely on your income for their day-to-day needs and future goals. With life insurance, you can have peace of mind knowing that your loved ones will be financially supported even after you're gone.

A. Replacement of lost income for beneficiaries

Life insurance provides a crucial replacement for lost income for beneficiaries. In the unfortunate event of your passing, your loved ones will receive a death benefit that can help replace the financial support you provided. This ensures that their financial needs, such as daily living expenses, education costs, and future plans, continue to be met. The death benefit can act as a source of income to help sustain their standard of living and maintain financial stability.

B. Support for family members and dependents

Life insurance not only provides financial protection for your loved ones, but it also offers support for family members and dependents. The death benefit can help cover immediate expenses, such as funeral costs, as well as provide ongoing financial support for their living expenses, education, and future aspirations. This support ensures that your family members can maintain their standard of living and continue to pursue their goals even in your absence.

Debt Payoff and Mortgage Protection

Life insurance can also provide valuable support for debt payoff and mortgage protection. In the event of your death, the death benefit can be used to pay off any outstanding debts, such as credit card balances or loans, ensuring that your loved ones are not burdened with these financial obligations. Additionally, life insurance can help safeguard your home by providing funds to cover mortgage payments, preventing your family from potentially losing their home. This ensures that your family can continue to live in a stable and secure environment, even in difficult times.

A. Paying off outstanding debts and loans

Life insurance can be a valuable tool for paying off outstanding debts and loans. In the event of your death, the death benefit can be used to clear any outstanding balances, such as credit card debt or loans. This ensures that your loved ones are not burdened with these financial obligations and can help provide them with a fresh start.

B. Safeguarding your home through mortgage protection

One of the important benefits of life insurance is mortgage protection. With mortgage protection, your loved ones can continue living in the family home even if you pass away. The death benefit from your life insurance policy can be used to pay off the remaining mortgage balance, ensuring that your home remains in your family's possession. This provides peace of mind and financial stability for your loved ones during a difficult time.

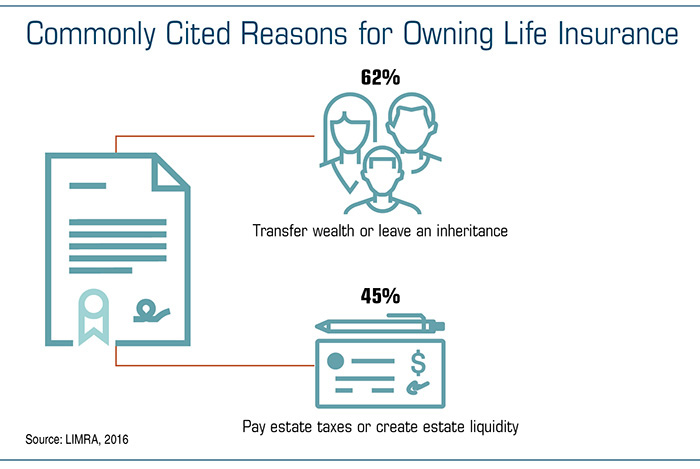

Estate Planning and Inheritance

Estate planning is an essential component of life insurance. It ensures the smooth transfer of your assets and wealth to your beneficiaries upon your passing. Life insurance policies can be used to provide funds for estate taxes, probate costs, and other expenses related to the distribution of your estate. This helps minimize the financial burden on your loved ones and ensures that your wishes are carried out effectively.

A. Ensuring smooth transfer of assets and wealth

Ensuring the smooth transfer of assets and wealth is a crucial aspect of estate planning. Life insurance can provide the necessary funds to cover estate taxes, probate costs, and other expenses related to the distribution of the estate. This helps minimize the financial burden on beneficiaries and ensures that the wishes of the policyholder are carried out effectively.

B. Minimizing estate taxes and probate costs

Minimizing estate taxes and probate costs is another important benefit of life insurance. By designating beneficiaries and utilizing strategies such as creating an irrevocable life insurance trust (ILIT), individuals can ensure that their assets pass directly to their loved ones without going through the lengthy and costly probate process. Additionally, life insurance proceeds are generally not subject to income tax, providing further financial relief to beneficiaries.

Peace of Mind and Future Planning

Life insurance provides peace of mind knowing that your loved ones will be financially supported in the event of your death. It allows you to plan for the future and ensures that your family can maintain their current standard of living and achieve their goals, such as funding education or retirement. By securing life insurance coverage, you can have confidence in the financial security and stability of your loved ones.

A. Peace of mind for you and your loved ones

Having life insurance provides peace of mind for both you and your loved ones. Knowing that your family will be financially supported in the event of your death can alleviate anxiety and stress. It ensures that they will be able to maintain their current standard of living and meet their financial needs, giving you the reassurance that they will be cared for even when you're no longer around.

B. Planning for future goals and expenses

Proper financial planning is crucial for achieving future goals and expenses. Life insurance can play a vital role in this process by providing the necessary funds to support major life events such as education, marriage, or retirement. By including life insurance in your financial plan, you can ensure that you have the resources to meet your long-term goals and secure a stable future for you and your loved ones.

Conclusion

In conclusion, life insurance is a crucial component of any comprehensive financial plan. It provides financial security and protection for your loved ones, replaces lost income, pays off debts, helps with estate planning, and brings peace of mind for the future. Taking the necessary steps to obtain life insurance coverage ensures that your loved ones and your financial goals are protected in the event of unexpected circumstances.

A. Summary of the importance of life insurance

Life insurance is essential for providing financial security and protection to loved ones in the event of unexpected circumstances. It replaces lost income, pays off debts, helps with estate planning, and brings peace of mind for the future. Taking steps to obtain life insurance coverage ensures that both loved ones and financial goals are protected.

B. Steps to take in getting life insurance coverage

When getting life insurance coverage, it is important to follow specific steps to ensure you find the right policy that meets your needs. These steps include:

- Assess your needs: Determine the amount of coverage you require based on factors such as your income, debts, and future financial goals.

- Research different policies: Compare the types of life insurance policies available, such as term life, whole life, or universal life, to find the best fit for your circumstances.

- Evaluate insurance providers: Research and compare different insurance companies, considering factors such as their financial stability and customer reviews.

- Get multiple quotes: Request quotes from different insurance providers to compare premiums and coverage options.

- Seek professional advice: Consult with a licensed insurance agent or financial advisor who can provide guidance on selecting the right policy and coverage amount.

- Complete the application process: Fill out the necessary paperwork accurately and provide any required documentation, such as medical or financial information.

- Undergo a medical examination: Depending on the policy and coverage amount, you may need to undergo a medical examination to assess your health and determine your insurability.

- Review the policy details: Carefully review the policy terms, conditions, and exclusions to ensure you understand the coverage and any limitations.

- Finalize the policy: Once you are satisfied with the policy terms and have chosen the right coverage, complete the necessary paperwork and make any required payments.

- Keep the policy updated: Regularly review your policy to ensure it still meets your needs as your circumstances change, such as marriage, having children, or purchasing a home.

By following these steps, you can navigate the process of obtaining life insurance coverage effectively and confidently.