Household insurance is a type of insurance coverage that provides financial protection for homeowners and their families in the event of damages or losses to their property. It is important for homeowners to have household insurance as it safeguards their investment and provides peace of mind. This article will delve into the different types of household insurance coverage, the components of a household insurance policy, the benefits and advantages of having household insurance, how to choose the right policy, and the process of filing a household insurance claim.

What is household insurance and why is it important?

Household insurance is a type of insurance coverage that provides financial protection for homeowners and their families in the event of damages or losses to their property. It is important for homeowners to have household insurance as it safeguards their investment and provides peace of mind. Household insurance protects against the unexpected, such as natural disasters, accidents, theft, and liability claims. It ensures that homeowners are not left financially burdened and can rebuild or repair their property in case of any unfortunate events.

Different types of household insurance coverage

There are various types of household insurance coverage available to homeowners. Some of the most common types include:

- Building insurance: This provides coverage for the structure of the home, including walls, roof, and foundation.

- Contents insurance: This covers the belongings inside the home, such as furniture, appliances, and personal belongings.

- Personal liability insurance: This provides financial protection in case someone is injured on the insured property and the homeowner is found liable.

- Additional living expenses insurance: This covers the costs of temporary accommodation if the insured property becomes uninhabitable due to damage or loss.

- Home emergency insurance: This provides coverage for urgent repairs or emergencies, such as plumbing issues or broken windows.

- Legal expenses insurance: This covers the costs of legal proceedings related to the homeowner's property, such as disputes with neighbors or property damage claims.

It is important for homeowners to carefully assess their needs and choose the appropriate types of coverage to ensure comprehensive protection for their household.

Structure and Coverage

One important aspect of household insurance is its structure and coverage. A typical household insurance policy consists of various components that provide protection for both the property and the homeowner. This includes property coverage for the structure of the home, as well as contents coverage for personal belongings. Additionally, liability coverage is included to provide financial protection in case of accidents or injuries on the insured property. This comprehensive coverage offers homeowners peace of mind and security.

Components of household insurance policy

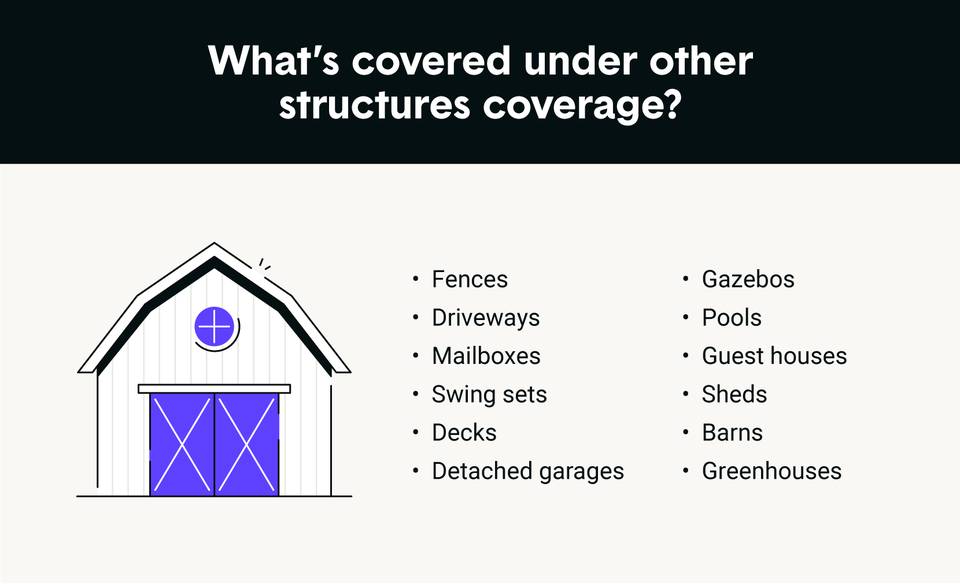

A household insurance policy typically consists of several key components that provide comprehensive coverage for homeowners. These components include property coverage, which protects the structure of the home and any attached structures. Contents coverage is also included to protect personal belongings within the home. Additionally, liability coverage is included to provide financial protection in case of accidents or injuries that occur on the insured property. These components work together to provide homeowners with the necessary protection and peace of mind.

Property coverage and protection

Property coverage is a key component of a household insurance policy that provides protection for the structure of the home and any attached structures. This coverage safeguards against damage caused by natural disasters such as fire, storms, or vandalism. It provides financial support for repairs or rebuilding, ensuring homeowners are protected from unexpected expenses and can restore their property to its pre-loss condition.

Liability coverage and financial protection

Liability coverage is an important component of household insurance that provides financial protection in the event that someone is injured on the property and holds the homeowners responsible. This coverage not only helps cover medical expenses but also legal costs if a lawsuit is filed. It protects homeowners from potential financial ruin and provides peace of mind knowing that they are protected against unexpected accidents.

Benefits and Advantages

Household insurance offers numerous benefits and advantages to homeowners. It provides peace of mind and a sense of security, knowing that their property and belongings are protected. In the event of natural disasters or accidents, such as fires or theft, homeowners can claim compensation for their losses. It also provides financial protection against liability claims, ensuring that homeowners are safeguarded from potential financial ruin. Overall, having household insurance offers homeowners the assurance that they are prepared for unexpected events and can recover financially in times of crisis.

Peace of mind and security

One of the key benefits of household insurance is the peace of mind and security it provides to homeowners. With the knowledge that their property and belongings are protected, homeowners can have a sense of calm and assurance. This insurance coverage gives them the confidence that they are prepared for unexpected events and can recover financially in times of crisis.

Protection against natural disasters and accidents

Household insurance provides homeowners with protection against natural disasters and accidents. This coverage ensures that homeowners can recover financially in the event of a fire, flood, earthquake, or other natural disasters. It also offers financial support in case of accidents, such as a pipe burst or a tree falling on the property. This coverage allows homeowners to repair damages and replace lost or damaged belongings without having to bear the full financial burden.

Choosing the Right Household Insurance

When selecting a household insurance policy, homeowners need to consider several factors. These include the coverage offered, the deductibles and premiums, the reputation and financial stability of the insurance provider, and any additional features or benefits included in the policy. It is essential to compare different insurance providers and policies to ensure the best fit for individual needs and budget. Homeowners should also assess their specific risks and requirements to customize their coverage accordingly.

Factors to consider when selecting a household insurance policy

When selecting a household insurance policy, homeowners need to consider several factors. These include the coverage offered, the deductibles and premiums, the reputation and financial stability of the insurance provider, and any additional features or benefits included in the policy. It is essential to compare different insurance providers and policies to ensure the best fit for individual needs and budget. Homeowners should also assess their specific risks and requirements to customize their coverage accordingly.

Comparing different insurance providers and policies

When selecting a household insurance policy, it is crucial to compare different insurance providers and policies. Homeowners should consider factors such as coverage options, deductibles and premiums, the reputation and financial stability of the insurance provider, and any additional features or benefits included in the policy. By comparing multiple options, homeowners can ensure they choose the best fit for their individual needs and budget.

Making a Claim

After purchasing a household insurance policy, homeowners may need to make a claim in the event of an unfortunate incident. The process of filing a claim typically involves contacting the insurance provider, providing the necessary documentation and evidence, and cooperating with the claims adjuster. It's important to understand the specific procedures and requirements outlined in your policy to ensure a smooth and successful claims process.

Process of filing a household insurance claim

The process of filing a household insurance claim typically involves the following steps:

- Contact the insurance provider: Notify your insurance company as soon as possible after the incident occurs.

- Provide documentation: Gather all necessary documentation, including a detailed description of the incident, photographs or videos, police reports (if applicable), and any other relevant evidence.

- Cooperate with the claims adjuster: The insurance company will assign a claims adjuster to handle your case. Cooperate fully with the adjuster, provide any requested information, and be responsive throughout the claims process.

- Follow the insurer's guidelines: Familiarize yourself with the specific procedures and requirements outlined in your policy, and adhere to them when filing your claim.

- Keep records: Maintain copies of all correspondence with your insurance company, including emails, letters, and phone call logs.

By following these steps and being proactive in providing the necessary documentation, you can help facilitate a smooth and efficient claims process.

Important documentation and evidence required

:max_bytes(150000):strip_icc()/titleinsurance-ef80077445c040029e7cd52f943b6a0c.jpg)

When filing a household insurance claim, it is important to provide the necessary documentation and evidence to support your claim. This may include a detailed description of the incident, photographs or videos of the damage or loss, police reports (if applicable), receipts or proof of ownership for stolen or damaged items, and any other relevant documents or evidence. By providing this information, you can help strengthen your claim and facilitate a smoother claims process.

Conclusion

In conclusion, household insurance provides essential coverage and protection for homeowners. It offers peace of mind and financial security in the event of property damage, theft, or liability claims. By carefully selecting the right insurance policy and providing the necessary documentation when making a claim, homeowners can ensure they have the necessary support and coverage to safeguard their homes. With household insurance, homeowners can have the reassurance that they are protected against unexpected events and can focus on enjoying their homes and lives without worry.

The importance of having household insurance

Having household insurance is crucial for homeowners as it provides essential coverage and financial protection in the event of property damage, theft, or liability claims. It offers peace of mind and security, ensuring that homeowners can recover from unexpected events without facing significant financial burdens. With the right insurance policy in place, homeowners can protect their most valuable asset and ensure their long-term financial stability.

Final thoughts and recommendations

In conclusion, household insurance is a crucial investment for homeowners, providing essential coverage and financial protection. It offers peace of mind and security, allowing homeowners to recover from unexpected events without facing significant financial burdens. When selecting a policy, it's important to carefully consider coverage options and compare different insurance providers. Overall, having household insurance is a wise decision that ensures long-term financial stability and protects one's most valuable asset.