Understanding Life Insurance

Understanding Life Insurance is crucial for individuals and families looking to protect their financial future. Life insurance is a contract between an individual and an insurance company, where the individual pays regular premiums in exchange for a lump sum payment or regular income to beneficiaries upon their death. It is important to understand the basics of life insurance, different types of policies, and the purpose it serves in order to make informed decisions regarding coverage options.

The Basics of Life Insurance

Life insurance is a contract between an individual and an insurance company. The individual pays regular premiums, and in return, the insurance company provides a lump sum payment or regular income to beneficiaries upon the individual's death. This financial protection ensures that loved ones are taken care of in the event of the insured's passing. Life insurance is an essential tool for providing financial security and peace of mind for individuals and their families.

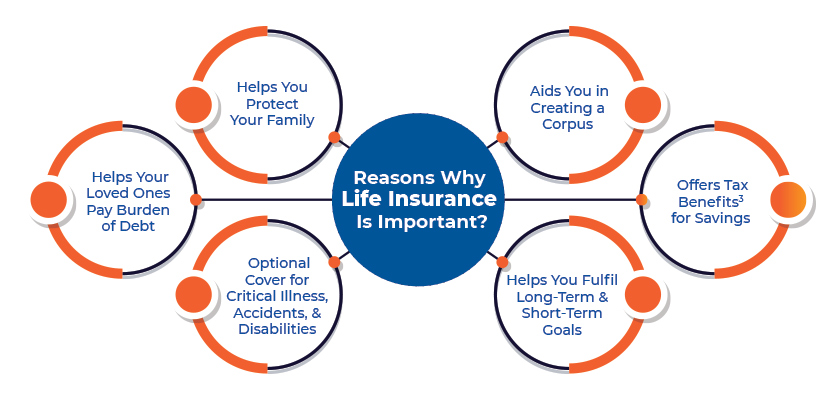

Why Life Insurance is Important

Life insurance is important because it provides financial security and peace of mind for individuals and their families. In the event of the insured's death, life insurance ensures that loved ones are taken care of and can maintain their standard of living. It can provide funds for funeral expenses, pay off debts, and provide income replacement. Life insurance safeguards against the financial impact of unexpected loss and ensures a secure future for beneficiaries.

Types of Life Insurance

Life insurance comes in different forms to meet the varying needs of individuals. The two main types of life insurance policies are term life insurance and whole life insurance.

- Term Life Insurance: This type of policy provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit to the beneficiary if the insured passes away during the term. Term life insurance is generally more affordable and suitable for those who need temporary coverage.

- Whole Life Insurance: Unlike term insurance, whole life insurance provides lifetime coverage. It combines a death benefit with a savings component called cash value. The premiums for whole life insurance are higher, but the policy accumulates cash value that can be borrowed against or used as an investment.

Both types of life insurance have their pros and cons, and the choice depends on the individual's financial goals and circumstances.

Term Life Insurance Explained

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term life insurance is a type of policy that provides coverage for a specified duration, typically 10, 20, or 30 years. It offers a death benefit to the beneficiary if the insured passes away during the term. Term life insurance is often more affordable than whole life insurance and is suitable for those who need temporary coverage for specific financial obligations, such as mortgage payments or education expenses. It does not accumulate cash value over time.

Whole Life Insurance Explained

Whole life insurance is a type of permanent life insurance that provides coverage for the lifetime of the insured. It offers a death benefit to the beneficiary upon the insured's death and also accumulates cash value over time. Whole life insurance premiums are typically higher than term life insurance premiums, but the coverage remains in effect as long as the premiums are paid. It is a suitable option for those seeking lifelong coverage and potential investment growth.

Determining the Purpose of Life Insurance

Determining the purpose of life insurance involves considering the specific needs and financial goals of the individual or family. The main purposes of life insurance are to provide protection for loved ones and replace lost income in the event of the insured's death. Additionally, life insurance can accumulate cash value and potentially serve as an investment tool. It can also play a role in estate planning and offer tax benefits. It is important to carefully assess these factors when choosing a life insurance policy.

Protection for Loved Ones

Protection for Loved Ones: Life insurance serves as a safety net for loved ones, providing financial security in the event of the insured's death. With a life insurance policy in place, beneficiaries will receive a death benefit payout that can help cover expenses such as funeral costs, mortgage payments, education expenses, and everyday living expenses. This ensures that loved ones are protected and can maintain their standard of living even after the insured's passing.

Income Replacement

Income Replacement: Life insurance can also serve as a means of income replacement, especially for those who are the primary earners in their families. In the event of the insured's death, the life insurance policy can provide a steady stream of income to help replace the lost earnings. This can help ensure that loved ones are financially supported and can maintain their standard of living even without the insured's income.

Additional Benefits of Life Insurance

In addition to providing protection and financial security, life insurance offers several additional benefits. One such benefit is the potential for cash value accumulation, where a portion of the premiums paid can grow over time and be accessed by the policyholder. This cash value can be used for various purposes, such as supplementing retirement income or funding educational expenses. Furthermore, life insurance can play a role in estate planning by providing a tax-efficient way to transfer wealth to beneficiaries. Overall, these additional benefits make life insurance a valuable financial tool for individuals and families.

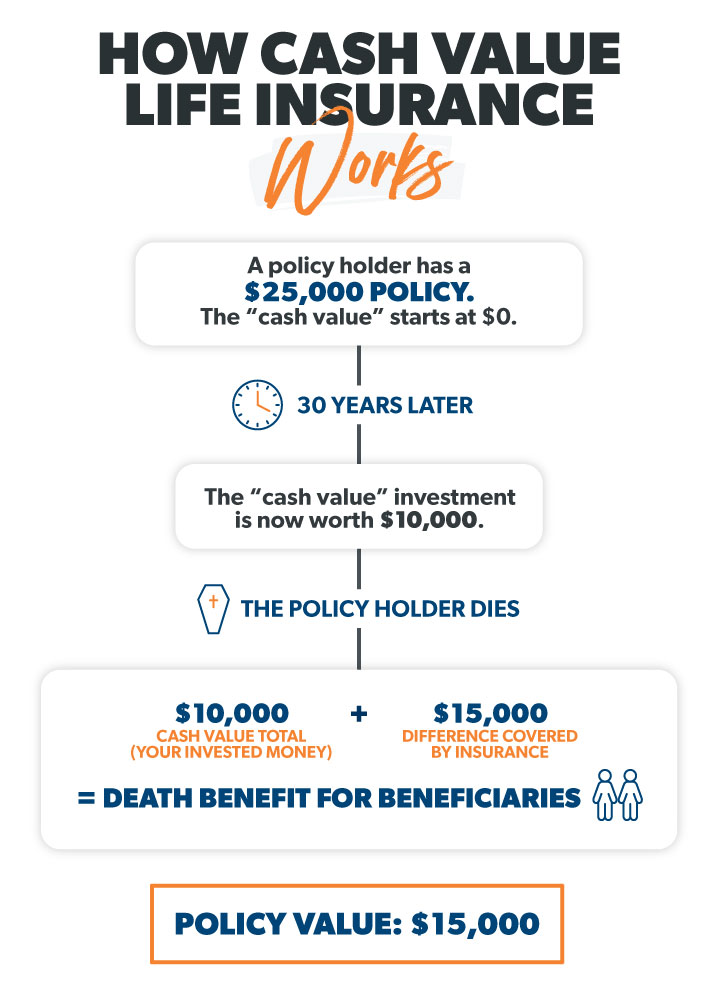

Cash Value and Investment Potential

Cash value is a unique feature of certain types of life insurance policies, such as whole life insurance. A portion of the premiums paid goes towards building cash value, which grows over time. Policyholders can access this cash value through loans or withdrawals. This provides an additional source of funds that can be used for various purposes like supplementing retirement income or funding educational expenses. It also offers the potential for investment growth, as the cash value can earn interest or be invested in the market. Overall, this feature adds a valuable dimension to life insurance by allowing policyholders to accumulate savings and potentially earn additional returns.

Estate Planning and Tax Benefits

Estate planning is an important aspect of life insurance, as it can help individuals manage their assets and ensure a smooth transfer of wealth to their heirs. Life insurance policies can help cover estate taxes and provide liquidity to pay off debts or expenses that may arise after death. Additionally, life insurance proceeds are generally income tax-free for beneficiaries, providing them with a tax-efficient inheritance. Considering the potential tax benefits and estate planning advantages, life insurance can be a valuable tool in ensuring a well-structured financial plan.

Factors to Consider when Choosing Life Insurance

When choosing life insurance, there are several important factors to consider. Age and health play a significant role in determining the type of policy and premiums. Evaluating the coverage amount is crucial to ensure adequate protection for loved ones. Comparing different policies and their features, such as cash value options and investment potential, can help individuals make an informed decision. By considering these factors, individuals can choose a life insurance policy that best meets their needs and financial goals.

Age and Health Factors

When choosing life insurance, it is important to consider age and health factors. Younger individuals typically have lower premiums as they are considered to be lower risk. On the other hand, older individuals or those with pre-existing health conditions may face higher premiums. Insurance providers may require a medical examination to assess any health risks. Evaluating your age and health will help determine the type of policy and coverage that best suits your needs and budget.

Coverage Amount and Premiums

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

When choosing life insurance, it is crucial to consider the coverage amount and premiums. The coverage amount should provide financial security for your loved ones in the event of your passing. It is essential to assess your family's needs, such as mortgage payments, education expenses, and daily living costs. Premiums will depend on factors like age, health, and the type of policy. It is advisable to compare quotes from different insurers to find the most affordable premiums for the desired coverage.

Conclusion

In conclusion, life insurance serves as a vital financial tool for protecting loved ones and providing income replacement in the event of the policyholder's death. It offers additional benefits like cash value and potential investment growth, as well as estate planning advantages and tax benefits. When choosing life insurance, it is crucial to consider factors such as age, health, coverage amount, and premiums to make an informed decision. Remember, life insurance is an investment in the future financial security of your family.

Making an Informed Decision

When choosing life insurance, it is important to make an informed decision. Consider factors such as age, health, coverage amount, and premiums to determine the type and amount of coverage that best suits your needs. Compare different policies from reputable insurance providers, and carefully review the policy terms and conditions. Seeking professional guidance from insurance agents or financial advisors can also help you navigate through the complexities of life insurance and make the right choice for you and your loved ones.

Common Misconceptions about Life Insurance

Common misconceptions about life insurance can prevent individuals from recognizing its true value and purpose. Some common misconceptions include thinking that life insurance is only necessary for older individuals or those with dependents, that it is too expensive, or that it is only for wealthy individuals. In reality, life insurance is important for anyone who wants to protect their loved ones financially and provide them with a secure future. It can also be affordable and offers various benefits beyond just a death benefit, such as cash value accumulation and tax advantages. Understanding these misconceptions and the true benefits of life insurance can help individuals make informed decisions about their financial security.