Introduction: Home insurance is an essential form of protection for homeowners. It provides financial coverage in the event of damage or loss to a house and its contents. With numerous insurance providers in the market, understanding the factors to consider, coverage options, costs, and claims process can help homeowners choose the best policy for their needs.

What is home insurance and why is it important?

Home insurance is a form of financial protection that covers homeowners in the event of damage or loss to their property and its contents. It provides peace of mind by safeguarding one's investment and assets. Home insurance is important as it helps homeowners recover financially from unexpected events such as natural disasters, theft, or accidents.

Factors to consider when choosing home insurance

When choosing home insurance, there are several factors to consider. These include the coverage options, the reputation and financial stability of the insurance provider, the cost of the policy, and the level of customer service and claims handling. It is important to thoroughly research and compare different policies before making a decision.

Coverage Options

When considering home insurance, it is important to understand the different coverage options available. Some of the common types of coverage include dwelling coverage, which protects the structure of your home, and personal property coverage, which covers the belongings inside your home. Other coverage options may include liability coverage, which protects you in case someone gets injured on your property, and additional living expenses coverage, which provides financial assistance if your home becomes uninhabitable. It is important to carefully consider your needs and choose the coverage options that best suit your situation.

Types of home insurance coverage

Types of home insurance coverage include dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. Dwelling coverage protects the structure of your home, while personal property coverage covers your belongings. Liability coverage protects against injuries on your property, and additional living expenses coverage helps if your home becomes uninhabitable. Choose the coverage options that suit your needs.

Dwelling coverage and its importance

Dwelling coverage is a crucial aspect of home insurance as it protects the structure of your home against perils such as fire, wind damage, and vandalism. It covers the cost of repairing or rebuilding your home, enabling you to restore your property and maintain its value. Ensure that your dwelling coverage amount is sufficient to cover the cost of rebuilding your home in the event of a total loss.

Personal property coverage and its limits

Personal property coverage is an essential component of home insurance. It protects your belongings, such as furniture, electronics, and clothing, from damage or loss. However, it's crucial to understand that there are limits to the coverage. These limits typically vary based on the policy and the type of item being covered. It's essential to review and understand the coverage limits to ensure that your valuable possessions are adequately protected.

Insurance Providers

When it comes to choosing the best home insurance, it's important to consider the insurance providers in the market. Some of the top providers include Allstate, State Farm, and Liberty Mutual. Each provider offers a variety of coverage options, so it's important to carefully review their offerings and compare them to find the best fit for your needs.

Top home insurance providers in the market

When it comes to home insurance, some of the top providers in the market include Allstate, State Farm, and Liberty Mutual. These providers offer a range of coverage options to suit different needs and budgets. It's important to carefully review their offerings and compare them to find the best fit for your home insurance needs.

Overview of coverage options offered by each provider

Allstate offers a variety of coverage options, including dwelling protection, personal property coverage, liability coverage, and additional living expenses coverage. State Farm provides similar coverage options, along with optional add-ons such as identity theft protection and earthquake coverage. Liberty Mutual offers coverage for the structure, personal belongings, liability, and additional living expenses, as well as optional coverage for water backup and identity fraud.

Cost and Discounts

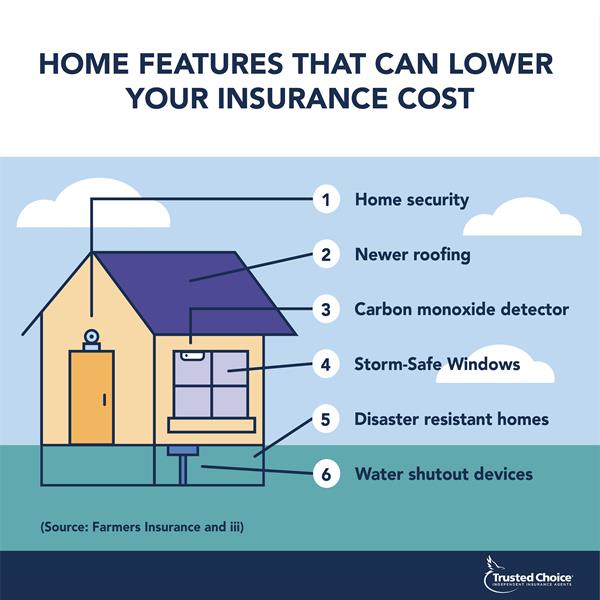

Determining the cost of home insurance depends on various factors such as the location and value of your property, your deductible amount, and the coverage limits you choose. Premium rates can also be affected by factors like your credit score and claims history. To save on home insurance, look for discounts offered by insurance providers, such as bundling policies, adding safety features to your home, or maintaining a good credit score. Comparing quotes from different providers can help you find the best rates and discounts for your specific needs.

Determining the cost of home insurance

When determining the cost of home insurance, several factors come into play. These include the location and value of the property, the deductible amount, and the coverage limits chosen. Additionally, factors like the credit score and claims history of the homeowner can impact premium rates. Comparing quotes from different insurance providers is crucial in finding the best rates and discounts.

Factors that affect premium rates

Several factors can influence the premium rates for home insurance. These include the location of the property, such as the risk of natural disasters or high crime rates. Other factors include the age and condition of the home, the homeowner's claims history, the coverage limits chosen, and even the credit score of the homeowner. All these factors are taken into account by insurers when determining the cost of home insurance.

Discounts and ways to save on home insurance

Many insurance providers offer various discounts and ways to save on home insurance premiums. Some common discounts include bundling policies, installing security systems or smoke detectors, having a claims-free history, or being a loyal customer. Additionally, raising deductibles or opting for a higher policy limit can help lower premiums. It's important to consult with insurance providers to explore all available discounts and ways to save on home insurance.

Claims Process

The claims process is the procedure you follow when filing a home insurance claim. It typically involves notifying your insurance provider about the loss or damage, providing necessary documentation and evidence, and working with claims adjusters to evaluate the extent of the loss. Once the claim is approved, you will receive the appropriate compensation according to your policy. It's important to understand the specific steps and requirements of your insurance provider's claims process to ensure a smooth and efficient experience.

Understanding the claims process

The claims process refers to the steps you need to follow when filing a home insurance claim. It involves notifying your insurance provider about the loss or damage, providing necessary documentation and evidence, and working with claims adjusters to evaluate the extent of the loss. Understanding the specific steps and requirements of your insurance provider's claims process is crucial for a smooth and efficient experience.

Tips for filing a home insurance claim

When it comes to filing a home insurance claim, there are a few tips that can help ensure a smooth and successful process:

- Report the claim promptly: Notify your insurance provider as soon as possible after experiencing a loss or damage to your home.

- Gather necessary documentation: Collect all relevant documentation, such as photos, receipts, and invoices, to support your claim.

- Provide accurate information: Be thorough and honest when providing information to your insurance provider. This includes providing a detailed description of the incident and any supporting evidence.

- Work with the claims adjuster: Cooperate with the claims adjuster assigned to your case and provide any additional information they may request.

- Keep records of communication: Document all conversations and correspondence with your insurance provider and claims adjuster.

- Follow up on the claim process: Regularly follow up with your insurance provider to stay informed about the status of your claim and any required next steps.

- Understand your policy coverage: Review your home insurance policy to understand the specific coverage and limits that apply to your claim.

- Keep copies of all documents: Make copies of all documents related to your claim, including the claim form, receipts, and any correspondence.

By following these tips, homeowners can navigate the claims process more effectively and increase the likelihood of a successful outcome.

Common pitfalls to avoid during the claims process

During the claims process, it's important to avoid common pitfalls that can hinder the success of your claim. Some common pitfalls to avoid include:

- Failing to report the claim promptly, which can result in delays or even denial of your claim.

- Providing inaccurate information or omitting crucial details, as it can lead to complications and potential claim denial.

- Not documenting the damage or loss thoroughly, as evidence is crucial for the evaluation of your claim.

- Neglecting to follow up on the claim's progress and failing to provide requested information promptly.

- Misunderstanding your policy coverage and not knowing the limits and exclusions that may affect your claim.

- Settling for a low settlement offer without seeking additional compensation that you may be entitled to.

By avoiding these common pitfalls, you can navigate the claims process more effectively and increase the chances of a successful outcome.

Conclusion

In conclusion, choosing the best home insurance requires careful consideration of factors such as coverage options, insurance providers, cost, and discounts. By understanding the claims process and avoiding common pitfalls, homeowners can ensure a successful outcome in the event of a claim. It is important to research and compare different policies to find the right one that meets your specific needs and provides adequate protection for your home and belongings.

Key takeaways on choosing the best home insurance

When choosing the best home insurance, it's important to carefully consider coverage options, research and compare insurance providers, factor in cost and discounts, and understand the claims process. By keeping these key points in mind, homeowners can make an informed decision to ensure their home and belongings are adequately protected.

Considerations for finding the right policy for your needs

When choosing the best home insurance policy for your needs, consider factors such as the coverage options offered, the reputation and financial stability of the insurance provider, the cost of the policy, and any available discounts. It's important to carefully review and compare policies to ensure you're adequately protected and getting the best value for your money.