Introduction to Life Insurance

Life insurance is a crucial financial tool that provides protection and financial security to individuals and their loved ones in the event of a tragedy. It offers policyholders the peace of mind in knowing that their family will be taken care of financially after their demise. By paying premiums, policyholders receive a death benefit that can be used to cover funeral expenses, replace lost income, pay off debts, or provide for the future needs of their dependents. With various types of life insurance policies available, individuals can choose the one that best suits their needs and goals.

Definition and importance of life insurance

Life insurance is a form of financial protection that ensures the well-being of loved ones in the event of the policyholder's death. It provides a lump sum payment, known as the death benefit, to beneficiaries. The importance of life insurance lies in its ability to provide financial security, replace lost income, cover funeral expenses, pay off debts, and provide for future needs. It offers peace of mind and ensures that loved ones are taken care of during a difficult time.

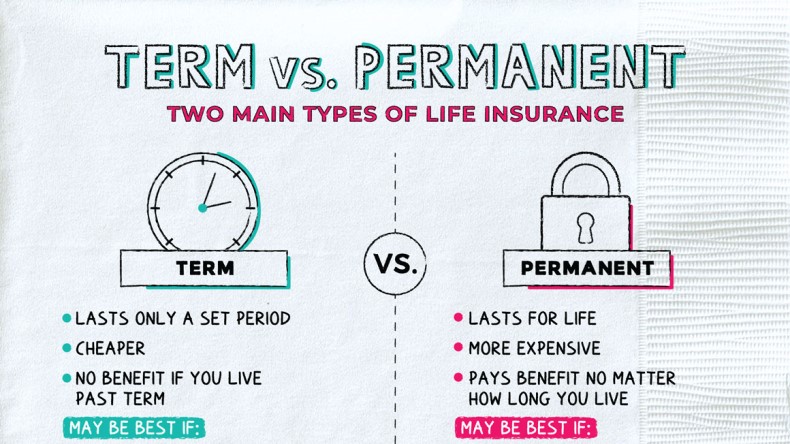

Different types of life insurance policies

There are several types of life insurance policies available to meet different needs and preferences:

- Term Life Insurance: Provides coverage for a specific period, usually 10, 20, or 30 years.

- Whole Life Insurance: Offers lifetime coverage and includes a cash value component that grows over time.

- Universal Life Insurance: Combines a death benefit with flexibility in premium payments and potential cash value growth.

- Variable Life Insurance: Allows policyholders to invest in various investment options and offers potential for higher returns, but also carries investment risks.

Choosing the right type of life insurance depends on factors such as budget, coverage needs, and long-term goals. Understanding the features and benefits of each policy can help individuals make informed decisions.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, usually 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured passes away during the term. Term life insurance is often more affordable than other types of life insurance and can be a good choice for individuals seeking temporary coverage or those on a tight budget. It does not accumulate cash value like whole or universal life insurance policies. When considering term life insurance, it's important to choose the right term length and coverage amount to meet your needs and protect your loved ones.

Features and benefits of term life insurance

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

Term life insurance offers several key features and benefits. Some of the main features include:

- Affordable premiums: Term life insurance policies generally have lower premiums compared to other types of life insurance.

- Flexible coverage options: You can choose a term length that aligns with your specific needs, such as 10, 20, or 30 years.

- Death benefit: If the insured person passes away during the term, a tax-free death benefit is paid out to the beneficiaries.

- Financial protection: Term life insurance provides a financial safety net for your loved ones in case of your untimely demise.

- Temporary coverage: Term life insurance is designed to provide coverage for a specific period, making it suitable for temporary needs such as paying off a mortgage or funding your children's education.

By considering these features and benefits, individuals can make an informed decision about whether term life insurance is the right option for their specific circumstances.

Factors to consider when choosing term life insurance

When choosing term life insurance, there are several factors to consider. These include:

- Coverage amount: Determine the amount of coverage you need to provide for your loved ones in case of your untimely demise.

- Term length: Consider how long you need the coverage to last, such as until your mortgage is paid off or until your children are financially independent.

- Premiums: Compare premiums from different insurers to ensure you are getting a competitive rate that fits your budget.

- Conversion options: Some term policies offer the ability to convert to a permanent policy in the future if your needs change.

- Insurer's reputation: Research the insurer's financial stability, customer service track record, and claims process to ensure you choose a reputable and reliable company.

By considering these factors, you can make an informed decision and select the term life insurance policy that best meets your needs and offers the desired level of financial protection.

Whole Life Insurance

:max_bytes(150000):strip_icc()/Grandmothergdoncouch-dadd4e8970b74fecbe6c8d251242291c.jpg)

Whole Life Insurance is a type of life insurance policy that provides coverage for the entire lifetime of the insured. It offers a guaranteed death benefit and also accumulates a cash value over time. This cash value can be accessed through withdrawals or loans and can provide additional financial flexibility. However, whole life insurance typically has higher premiums compared to term life insurance. It can be a good option for individuals who want lifelong coverage and are willing to pay higher premiums for the added benefits.

Features and benefits of whole life insurance

Whole life insurance offers several features and benefits that make it an attractive option for individuals seeking lifelong coverage. Some key features include a guaranteed death benefit, cash value accumulation, and premium stability. This type of policy also offers tax advantages, as the cash value grows tax-deferred. Furthermore, whole life insurance provides financial protection for loved ones and can be used as an estate planning tool.

Pros and cons of whole life insurance

Whole life insurance offers numerous benefits, including a guaranteed death benefit, cash value accumulation, premium stability, and tax advantages. It provides lifelong coverage and can be used as an estate planning tool. However, whole life insurance is generally more expensive than term life insurance and may have limited investment returns. Additionally, the cash value growth rate may be lower compared to other investment options. It is important to consider these factors when deciding if whole life insurance is the right choice.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that provides both a death benefit and a cash value component. This policy allows policyholders to adjust their coverage and premium payments, providing flexibility throughout their lifetime. Universal life insurance offers potential for cash value growth and may offer tax advantages. It is important to carefully review the policy terms and understand the potential risks and benefits before choosing universal life insurance.

Features and benefits of universal life insurance

Universal life insurance offers policyholders flexibility in adjusting their coverage and premium payments to meet their changing needs. Some key features and benefits of universal life insurance include:

- Death Benefit: Like other types of life insurance, universal life insurance provides a death benefit to beneficiaries upon the policyholder's passing.

- Cash Value Growth: Universal life insurance has a cash value component that can grow over time, providing potential for increased savings.

- Premium Flexibility: Policyholders have the ability to adjust their premium payments based on their financial situation, allowing for greater control and adaptability.

- Potential Tax Advantages: The cash value growth in universal life insurance policies may be tax-deferred, providing potential tax advantages for policyholders.

- Borrowing Options: Policyholders can borrow against the cash value of their universal life insurance policy, offering a source of funds for emergency expenses or other financial needs.

These features make universal life insurance an attractive option for individuals seeking flexibility and potential cash value growth in their life insurance coverage.

Understanding the cash value component of universal life insurance

Universal life insurance policies have a unique feature called the cash value component. This component allows policyholders to accumulate savings over time, as a portion of their premium payments go towards building cash value. The cash value grows on a tax-deferred basis and can be accessed by the policyholder through withdrawals or loans. It provides policyholders with a flexible way to grow their wealth while also maintaining life insurance coverage.

Variable Life Insurance

Variable Life Insurance:

Variable life insurance is a type of permanent life insurance that provides both a death benefit and a savings component. This policy allows policyholders to allocate their premiums into various investment options, such as mutual funds. The cash value of the policy fluctuates based on the performance of the investments, offering the potential for higher returns. However, it also carries more investment risk compared to other types of life insurance policies. Policyholders have the flexibility to adjust their premium payments and death benefit as needed.

Features and benefits of variable life insurance

Variable life insurance offers a unique combination of a death benefit and a savings component. Here are some key features and benefits of variable life insurance:

- Investment options: Policyholders can allocate their premiums into various investment options, such as mutual funds, allowing for potential higher returns.

- Cash value accumulation: The cash value of the policy grows over time based on the performance of the investments, providing potential tax-deferred growth.

- Flexibility: Policyholders have the flexibility to adjust their premium payments and death benefit amounts as their needs change.

- Death benefit protection: Variable life insurance provides a death benefit to beneficiaries upon the policyholder's passing, providing financial security for loved ones.

- Potential wealth accumulation: The investment component of variable life insurance allows for the potential growth of wealth over the long term.

It is important to note that variable life insurance carries more investment risk compared to other types of life insurance policies. Policyholders should consider their risk tolerance and investment objectives before purchasing a variable life insurance policy.

Investment options and risks associated with variable life insurance

Variable life insurance offers policyholders the opportunity to invest their premiums in various investment options, such as mutual funds. This can potentially result in higher returns compared to other types of life insurance. However, it is important to note that variable life insurance carries more investment risk. Policyholders should carefully consider their risk tolerance and investment objectives before selecting the investment options for their policy.

Conclusion

In conclusion, choosing the right type of life insurance policy is a crucial decision that requires careful consideration of various factors. Term life insurance offers affordable coverage for a specific period, while whole life insurance provides lifelong protection with cash value accumulation. Universal life insurance offers flexibility and investment potential, while variable life insurance allows policyholders to invest in various options with potentially higher returns. It is important to assess your needs, financial goals, and risk tolerance before selecting the most suitable life insurance policy. Seek guidance from a qualified insurance professional to make an informed decision.

Factors to consider when choosing a life insurance policy

When choosing a life insurance policy, it is important to consider several factors. These include the coverage amount needed to meet financial obligations, the duration of coverage required, and the premium affordability. Additionally, individuals should assess their health and lifestyle to determine if they may require additional riders or policies for specific needs. It is recommended to seek advice from a qualified insurance professional to evaluate these factors and select the most suitable policy.

Final thoughts and recommendations on selecting the right type of life insurance

In conclusion, selecting the right type of life insurance requires careful consideration of individual needs and financial goals. It is important to assess factors such as coverage amount, duration of coverage, and premium affordability. Seeking advice from a qualified insurance professional can provide valuable insights and assistance in choosing the most suitable policy. Remember to regularly review and update your life insurance coverage as your circumstances change.