Understanding Homeowners Insurance

Understanding Homeowners Insurance is vital for homeowners to protect their most valuable asset. It provides coverage for the structure of the home, personal belongings, liability, and additional living expenses in the event of a covered loss. Homeowners should assess their coverage needs, compare quotes from different insurance providers, and regularly review and update their policies to ensure they have adequate protection. Having a comprehensive understanding of homeowners insurance can help homeowners make informed decisions and safeguard their investments.

A What is Homeowners Insurance?

Homeowners insurance is a type of insurance policy that provides coverage for homeowners in the event of damage to their property or belongings. It typically includes protection for the structure of the home, personal belongings, liability, and additional living expenses. Homeowners insurance helps safeguard one's investment and provides financial security in case of unexpected events such as fire, theft, or natural disasters.

B Importance of Homeowners Insurance Coverage

Homeowners insurance coverage is of vital importance as it provides financial protection and peace of mind to homeowners. It safeguards them against potential losses due to property damage, theft, or liability claims. With the right policy, homeowners can recover from unexpected events and maintain the value of their investment. It is a responsible choice to ensure one's home and belongings are adequately protected.

Coverage Options and Policies

Coverage options and policies for homeowners insurance can vary depending on the insurance provider. Some common coverage options include dwelling coverage, which protects the structure of the home, and personal property coverage, which protects belongings inside the home. Other options may include liability coverage for injuries or damage caused by the homeowner, and additional endorsements for specific risks such as water damage. It is important for homeowners to carefully review their options and choose the policies that best suit their needs.

A Dwelling Coverage

Dwelling coverage is a key component of homeowners insurance that protects the structure of the home itself. This coverage extends to the walls, roof, floors, and other permanent structures attached to the home. In the event of damage caused by covered perils such as fire, windstorm, or vandalism, dwelling coverage helps cover the costs of repairs or rebuilding. It is important for homeowners to accurately evaluate the value of their home and choose adequate dwelling coverage to ensure proper protection.

B Personal Property Coverage

Personal Property Coverage is another important aspect of homeowners insurance. This coverage protects the personal belongings inside the home, such as furniture, appliances, electronics, and clothing, in case of damage or theft. The coverage usually extends to items both inside and outside the home, but limits may apply for high-value items like jewelry or art. It is essential for homeowners to accurately assess the value of their personal property and choose adequate coverage to protect their belongings.

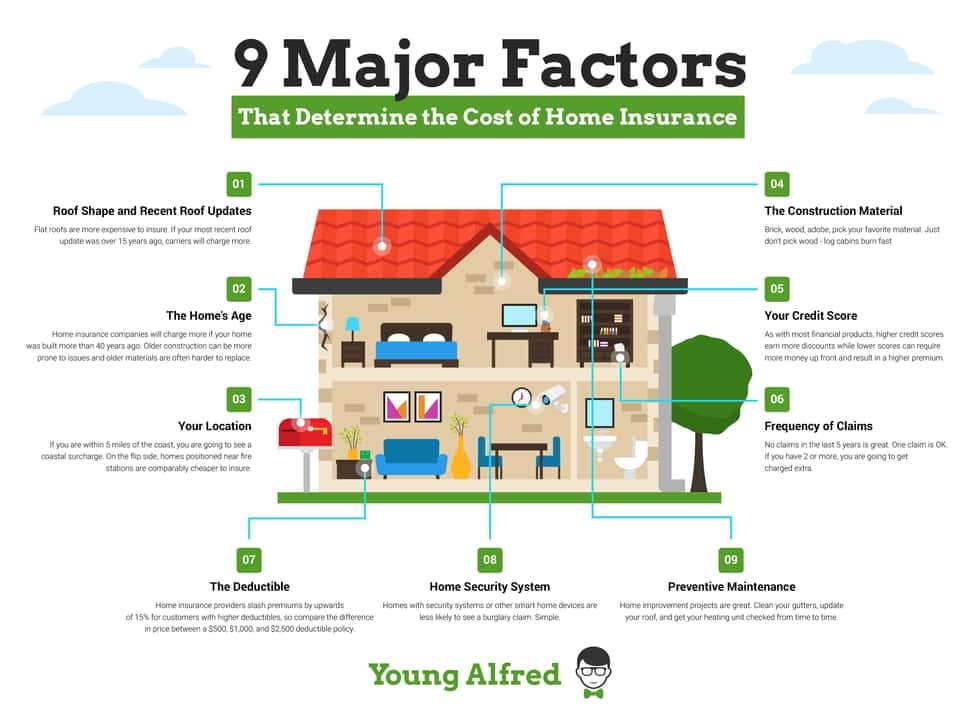

Factors Affecting Homeowners Insurance Rates

There are several factors that can affect homeowners insurance rates. These include the location of the property, the age and condition of the house, the materials used in construction, the presence of safety features such as smoke detectors or a security system, the insurance claims history of the policyholder, and the coverage limits and deductibles chosen. Insurance providers also consider the credit history of the policyholder and the proximity to fire hydrants and fire stations.

A Location and Property Characteristics

The location and specific characteristics of a property can significantly impact homeowners insurance rates. Factors such as the proximity to fire hydrants and fire stations, the area's weather conditions (e.g., hurricanes, earthquakes), and the crime rate in the neighborhood can all affect the insurance premiums. Furthermore, the age and condition of the house, the materials used in its construction, and the presence of safety features like smoke detectors and security systems also play a role in determining insurance rates. Insurance providers take these factors into account when calculating the policy costs to appropriately assess the potential risks associated with insuring a specific property. Regularly reviewing and updating homeowners insurance policies is crucial to ensure that coverage adequately protects against potential risks and to evaluate if any changes in location or property characteristics necessitate adjustments in coverage.

B Policyholder's Claims History

The policyholder's claims history is another important factor that can affect homeowners insurance rates. Insurance companies will review the policyholder's past claims to assess the level of risk they pose. Policyholders with a history of frequent or high-value claims may be considered higher risk and may face higher insurance premiums. On the other hand, policyholders with a clean claims history may be eligible for lower rates or discounts. Insurers use this information to determine the likelihood of future claims and adjust rates accordingly.

Additional Coverage and Endorsements

Additional coverage and endorsements are options that homeowners can add to their insurance policies to enhance their coverage. Some common additional coverage options include liability coverage, which protects against lawsuits for property damage or injuries; and water damage coverage, which covers damage caused by leaks or flooding. Adding these endorsements can provide extra protection and peace of mind for homeowners. It is important for homeowners to carefully consider their specific needs and consult with their insurance provider to determine the additional coverage options that would be most beneficial for them.

A Liability Coverage

Liability coverage is an important additional coverage option for homeowners insurance. It protects the policyholder against lawsuits and claims for property damage or injuries that occur on their property. This coverage can help cover legal expenses and financial settlements if the policyholder is found liable for the damages. It provides peace of mind and financial protection, making it a valuable addition to homeowners insurance policies.

B Water Damage Coverage

Water damage coverage is an important aspect of homeowners insurance. It protects the policyholder against damages caused by water-related incidents such as burst pipes, plumbing leaks, or roof leaks. This coverage typically includes the cost of repairing or replacing damaged property and can help cover expenses related to water cleanup and restoration. It provides financial protection and peace of mind against unexpected water damage events.

Choosing the Right Homeowners Insurance

Choosing the right homeowners insurance is crucial for protecting your property and personal belongings. When assessing coverage needs, consider factors such as the value of your home and possessions, desired deductible amount, and specific coverage requirements. Comparing quotes and evaluating insurance providers can help you find the best policy that offers adequate protection at a competitive price. Take the time to review the policy details and terms carefully to ensure it meets your needs.

A Assessing Coverage Needs

When assessing coverage needs for homeowners insurance, it is important to consider factors such as the value of your home and possessions, as well as any specific coverage requirements you may have. Take into account the replacement cost of your home and personal belongings, as well as any potential risks in your area, such as natural disasters or high crime rates. Additionally, evaluate your financial ability to pay for potential losses and choose a deductible amount that aligns with your budget. Assessing coverage needs will help ensure that you choose a homeowners insurance policy that adequately protects your assets.

B Comparing Quotes and Evaluating Insurance Providers

When comparing quotes for homeowners insurance, it's important to obtain multiple quotes from different insurance providers. Take the time to carefully review and compare the coverage options, deductibles, limits, and premiums offered by each provider. Additionally, research the reputation and financial stability of the insurance company to ensure they can meet their obligations in the event of a claim. Consider reading customer reviews and consulting independent rating agencies to evaluate the insurer's customer service and claims handling.

Conclusion

In conclusion, homeowners insurance is a vital protection for homeowners, providing coverage for their property and belongings in case of damage or loss. It is important to understand the different coverage options and factors that affect insurance rates when choosing a policy. By comparing quotes and evaluating insurance providers, homeowners can select a policy that best meets their needs. Regularly reviewing and updating homeowners insurance policies is crucial to ensure proper coverage as circumstances change.

A Importance of Regularly Reviewing and Updating Homeowners Insurance Policies

Regularly reviewing and updating homeowners insurance policies is crucial to ensure that homeowners have adequate coverage for their changing needs. This includes reassessing coverage limits, deductibles, and endorsements, as well as updating policy details such as home renovations or additions. By staying proactive, homeowners can make sure they are protected against any potential risks or gaps in coverage. Additionally, reviewing policies can also help identify any potential discounts or savings opportunities.

B Frequently Asked Questions

B Frequently Asked Questions:

- How much homeowners insurance coverage do I need?

It depends on factors such as the value of your home, belongings, and desired level of protection. Consider consulting with an insurance agent who can provide personalized recommendations.

- What does homeowners insurance typically cover?

Homeowners insurance typically covers the structure of your home, personal belongings, liability for injuries or property damage, and additional living expenses if your home becomes uninhabitable.

- Are there any discounts available for homeowners insurance?

Yes, many insurance companies offer discounts for factors such as having security systems, bundled policies, or a good claims history. It's worth exploring potential discounts to lower your premium.

- Do I need additional coverage for natural disasters?

Some natural disasters like earthquakes or floods may require separate coverage. Standard policies typically exclude these events, so it's important to assess your risk and consider purchasing additional coverage if necessary.

- What should I do if I have a claim?

If you need to file a claim, contact your insurance company as soon as possible. Document any damage, gather evidence, and provide all necessary information to expedite the claims process.

Remember, it's essential to review and update your homeowners insurance regularly to ensure it aligns with your changing needs and offers adequate protection.