Understanding Health Insurance Basics

Health insurance is a type of coverage that helps individuals pay for medical expenses. It provides financial protection and ensures access to healthcare services. Understanding the basics of health insurance is crucial in selecting the right plan for your needs. This includes knowing the different types of policies, understanding policy terms and conditions, and evaluating coverage options. By having a solid understanding of health insurance basics, you can make informed decisions when it comes to your healthcare needs.

A What is health insurance?

Health insurance is a type of coverage that helps individuals pay for their medical expenses. It is a contract between the policyholder and the insurance company, where the policyholder pays regular premiums in exchange for the insurer covering a portion of their healthcare costs. Health insurance provides financial protection and ensures access to healthcare services, giving individuals peace of mind and the ability to seek necessary medical treatment when needed.

B Why do you need health insurance?

Health insurance is essential for several reasons. First, it provides financial protection against unexpected medical expenses, ensuring that you are not burdened with unmanageable bills. Second, health insurance grants you access to a network of healthcare providers, allowing you to receive timely and quality treatment. Lastly, it promotes preventive care and wellness, covering routine check-ups and screenings to catch potential health issues early on. Obtaining health insurance ensures that you can safeguard your health and receive the necessary medical care when required.

Evaluating Your Health Insurance Needs

When evaluating your health insurance needs, it's important to assess your healthcare requirements and determine the level of coverage you require. Consider factors such as your age, current health conditions, and anticipated medical expenses. Additionally, think about whether you need coverage for prescription drugs, specialist visits, or hospital stays. By understanding your specific needs, you can select a health insurance plan that provides comprehensive coverage tailored to your requirements.

A Assessing your healthcare needs

Assessing your healthcare needs is an essential step in determining the right health insurance plan for you. Consider your age, current health conditions, and any anticipated medical expenses. Think about whether you need coverage for prescription drugs, specialist visits, or hospital stays. By evaluating your specific needs, you can select a plan that provides comprehensive coverage tailored to your requirements.

B Determining the level of coverage you require

When determining the level of coverage you require, consider your individual healthcare needs and financial situation. Evaluate factors such as your age, current health conditions, and anticipated medical expenses. Consider whether you need coverage for prescription drugs, specialist visits, or hospital stays. Additionally, assess your budget and determine how much you can afford for monthly premiums and out-of-pocket costs. This will help you choose a health insurance plan that aligns with your specific needs and budget.

Exploring Different Health Insurance Options

When exploring different health insurance options, individuals can consider employer-sponsored health insurance plans or individual health insurance plans. Employer-sponsored plans are provided through an individual's employer, while individual plans are purchased directly from insurance companies. It is important to compare the benefits, costs, and coverage limits of each option to determine which plan best meets your needs and budget. Additionally, consider factors such as network coverage and prescription drug coverage when evaluating different health insurance options.

A Employer-sponsored health insurance

Employer-sponsored health insurance is a type of coverage provided by an individual's employer. It offers a range of benefits and options at a group rate, potentially making it more cost-effective than individual plans. The employer typically covers a portion of the premium, and employees may have the option to add dependents to their plan. This type of insurance often provides access to a network of healthcare providers and may offer additional benefits such as dental and vision coverage.

B Individual health insurance plans

Individual health insurance plans are purchased by individuals directly from insurance companies. These plans provide coverage for the policyholder only, and do not include dependents. Individual health insurance plans offer more flexibility in terms of options and coverage levels. They can be a good choice for self-employed individuals, those without access to employer-sponsored plans, or individuals who want more control over their healthcare choices.

Comparing Health Insurance Plans

When comparing health insurance plans, it is important to understand the policy terms and conditions. Look at factors such as premiums, deductibles, and coverage limits to determine the best plan for your needs. Consider the network of doctors and hospitals included in each plan. It is also helpful to compare the benefits offered, including coverage for prescription drugs, preventive care, and specialist visits. By carefully comparing these factors, you can choose a plan that offers the most comprehensive coverage at an affordable price.

A Understanding policy terms and conditions

When comparing health insurance plans, it is crucial to understand the policy terms and conditions. This includes reviewing the fine print, such as exclusions, limitations, and pre-authorization requirements. Pay attention to the network of doctors and hospitals included and any restrictions on out-of-network care. It is also essential to understand what services and treatments are covered, including prescription drugs, specialist visits, and preventive care. By carefully reviewing and understanding these policy details, you can ensure that you select a plan that meets your specific healthcare needs.

B Comparing premiums, deductibles, and coverage limits

:max_bytes(150000):strip_icc()/Are-health-insurance-premiums-tax-deductible-4773286_v1-dbe23582da6346498c4596ab0bfa05f2.jpg)

When comparing health insurance plans, it is essential to consider factors such as premiums, deductibles, and coverage limits. Premiums refer to the amount you pay monthly for the insurance plan. Deductibles are the amount you must pay out of pocket for medical services before the insurance starts covering costs. Coverage limits determine the maximum amount the insurance will pay for certain services or treatments. Reviewing and comparing these aspects can help you determine which plan offers the best value for your healthcare needs.

Applying for Health Insurance

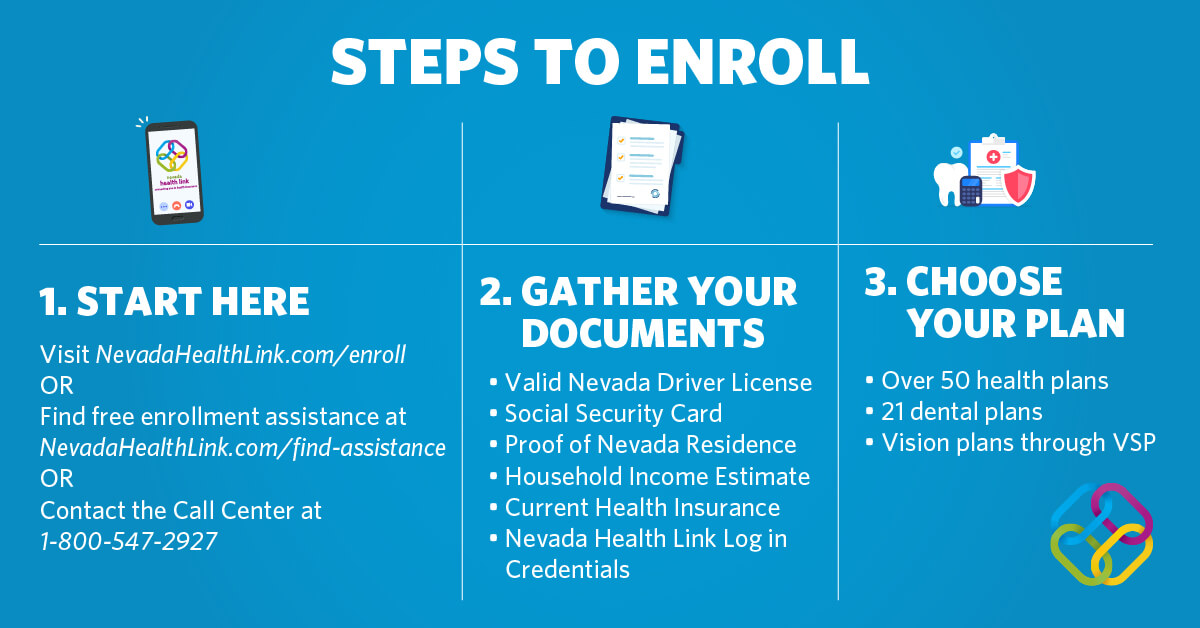

Applying for health insurance is a straightforward process that requires gathering necessary documents and information. These include proof of identity, financial information, and any relevant medical history. Once you have all the required documents, you can complete the application process either online, by phone, or in person. It is important to provide accurate information and carefully review the application before submitting it.

A Gathering necessary documents and information

When applying for health insurance, it is essential to gather the necessary documents and information to expedite the process. These may include proof of identity, such as a driver's license or passport, financial information like tax returns or pay stubs, and any relevant medical history, such as previous diagnoses or prescribed medications. Having these documents ready will ensure a smooth application process and accurate coverage.

B Complete the application process

To complete the health insurance application process, carefully review the application for accuracy and completeness. Ensure all required fields are filled in and any necessary documents are attached. Double-check that you have provided all relevant information, such as personal details and medical history. Submit the application by the specified deadline and follow up with the insurance company to confirm receipt and request any further information if needed.

Utilizing Your Health Insurance

Once you have secured health insurance coverage, it's important to understand how to fully utilize it. Take the time to familiarize yourself with your policy's coverage and benefits. This will help you make informed decisions about your healthcare and take advantage of any preventive care or medical services included in your plan. By utilizing your health insurance effectively, you can effectively manage your healthcare costs and ensure that you receive the necessary medical care when needed.

A Understanding your coverage and benefits

When it comes to utilizing your health insurance, understanding your coverage and benefits is crucial. Take the time to review your policy documents and familiarize yourself with what is covered under your plan. This includes knowing the network of healthcare providers and facilities that accept your insurance. Additionally, understanding any limitations, exclusions, or co-pays can help you make informed decisions about your healthcare. By having a clear understanding of your coverage and benefits, you can effectively navigate the healthcare system and optimize your insurance benefits.

B Making the most of preventive care and medical services

Taking advantage of preventive care and medical services is essential to maintaining good health and preventing more serious issues down the line. Regularly scheduled check-ups, vaccinations, screenings, and wellness visits can help detect and address potential health concerns early on. By staying up to date with recommended preventive care, individuals can maximize their health insurance benefits and ensure they are proactive in managing their well-being.