Understanding Permanent Life Insurance

Permanent life insurance is a type of life insurance policy that provides coverage for the entire lifetime of the insured, as long as the premiums are paid. Unlike term life insurance, which only provides coverage for a specific period of time, permanent life insurance offers lifelong protection. It also includes a cash value component that grows over time. Permanent life insurance can offer financial security and peace of mind to policyholders and their loved ones.

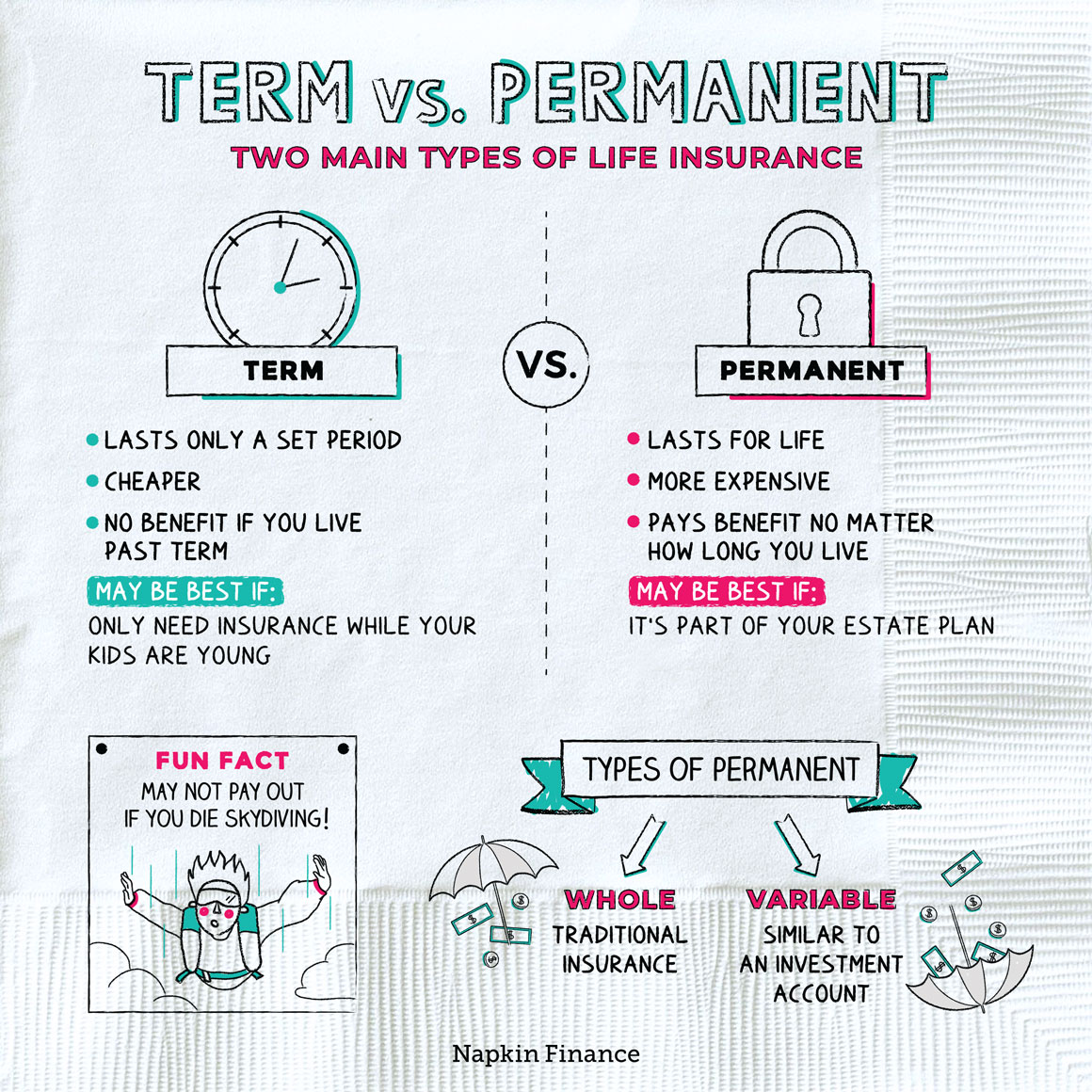

I Types of life insurance policies

There are two main types of life insurance policies: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is more affordable but does not build cash value. Permanent life insurance, on the other hand, offers coverage for the entire lifetime of the insured and includes a cash value component that grows over time. It can be further divided into whole life insurance and universal life insurance options.

II Key features and benefits of permanent life insurance

Permanent life insurance offers several key features and benefits. These include:

- Lifetime coverage: Unlike term life insurance, permanent life insurance provides coverage for the entire lifetime of the insured.

- Cash value accumulation: Permanent life insurance policies have a cash value component that grows over time. This cash value can be accessed through withdrawals or policy loans.

- Tax advantages: The cash value growth within a permanent life insurance policy is tax-deferred, meaning you won't owe taxes on the growth until you withdraw the funds.

- Flexibility: Permanent life insurance policies often allow you to adjust the death benefit and premium payments to match your changing needs and financial situation.

- Estate planning: Permanent life insurance can be used as a tool for estate planning, providing a tax-free death benefit to beneficiaries and helping cover estate taxes or other expenses.

These features and benefits make permanent life insurance an attractive option for those looking for long-term coverage and potential cash value growth.

Assessing Your Insurance Needs

As an individual considering the purchase of permanent life insurance, it is important to assess your insurance needs. This involves evaluating your financial goals and responsibilities to determine the appropriate coverage amount and duration. Take into consideration factors such as income, debts, dependents, and future financial obligations. By understanding your insurance needs, you can make an informed decision about the type and amount of permanent life insurance that is right for you.

I Evaluating your financial goals and responsibilities

When evaluating your financial goals and responsibilities in relation to permanent life insurance, it is essential to assess your current financial situation. Consider factors such as your income, debts, dependents, and future financial obligations. Determine how much coverage you would need to provide for your loved ones in the event of your passing and ensure that the policy duration aligns with your long-term financial goals. By evaluating these factors, you can make a more informed decision about the appropriate coverage amount and duration for your permanent life insurance policy.

II Determining the right coverage amount and duration

Determining the right coverage amount and duration for your permanent life insurance policy is crucial to ensure that your loved ones are adequately protected. Consider factors such as your current income, future financial obligations, debts, and dependents. Calculate the amount needed to cover these expenses and choose a policy duration that aligns with your long-term financial goals. It is essential to seek guidance from an insurance professional to accurately determine the appropriate coverage amount and duration for your specific needs.

Choosing the Right Permanent Life Insurance Policy

When it comes to choosing the right permanent life insurance policy, there are two main options to consider: whole life insurance and universal life insurance. Whole life insurance offers steady premiums and a guaranteed death benefit, while universal life insurance provides flexibility in premium payments and the potential to accumulate cash value. It's important to carefully evaluate your financial goals and priorities to determine which type of policy aligns best with your needs. Consulting with an insurance professional can provide valuable guidance in making this decision.

I Whole life insurance

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime. It offers steady premiums and a guaranteed death benefit. Additionally, whole life policies also accrue cash value over time, which can be accessed through policy loans or withdrawals. This type of policy is suitable for individuals seeking lifelong coverage and the potential for cash value accumulation.

II Universal life insurance

Universal life insurance is another type of permanent life insurance that offers flexibility and potential for higher cash value accumulation. It provides a death benefit along with a savings component. With universal life insurance, policyholders have the option to adjust the premium payments and death benefit amount over time. This type of policy is suitable for individuals looking for flexibility in their coverage and the potential for investment growth within their policy.

Factors to Consider When Buying Permanent Life Insurance

When buying permanent life insurance, there are several factors to consider to ensure you choose the right policy for your needs. These factors include the premiums and payment options, as well as the cash value accumulation and policy loan features. It is important to carefully evaluate these factors to make an informed decision and select a policy that aligns with your financial goals and obligations.

I Premiums and payment options

When buying permanent life insurance, it is important to consider the premiums and payment options. Premiums are the regular payments you make to keep the policy in force. Permanent life insurance policies typically have higher premiums compared to term life insurance. However, they also offer cash value accumulation and other benefits. Payment options can vary, including annual, semi-annual, quarterly, or monthly payments. It is important to choose a payment option that aligns with your budget and financial goals.

II Cash value accumulation and policy loans

One of the key features of permanent life insurance is the ability to accumulate cash value over time. As you continue to pay your premiums, a portion of the money is set aside and grows tax-deferred within the policy. This cash value can be accessed through policy loans, allowing you to borrow against the value of the policy while it remains in force. It's important to note that policy loans accrue interest and may reduce the death benefit if not repaid.

Applying for Permanent Life Insurance

Applying for Permanent Life Insurance requires gathering necessary documents and information such as personal identification, medical history, and financial records. Once you have all the necessary information, you can submit your application to the insurance company. The application will then go through the underwriting process, where the company assesses your risk and determines your premium. It is important to be truthful and provide accurate information during this process. Seek guidance from an insurance professional to help navigate the application and underwriting process.

I Gathering necessary documents and information

When applying for permanent life insurance, it is important to gather all the necessary documents and information to complete the application process. This typically includes personal identification such as your driver's license or passport, medical history, financial records, and any other relevant documentation requested by the insurance company. Providing accurate information is crucial during this stage to ensure a smooth underwriting process. Seek guidance from an insurance professional to ensure you have all the required documents in order.

II Submitting your application and underwriting process

Once you have gathered all the necessary documents and information, it's time to submit your application for permanent life insurance. You will need to provide all the required documentation and answer the insurer's questions accurately. After the application is submitted, the underwriting process begins. During this process, the insurance company will review your application, assess your risk factors, and determine your premium. It is important to be honest and provide accurate information to ensure a smooth underwriting process.

Conclusion

In conclusion, buying permanent life insurance requires careful evaluation of your financial goals and responsibilities, selecting the right policy type, and considering factors such as premiums and cash value accumulation. It is essential to gather all necessary documents and provide accurate information during the application process. Seeking advice from an insurance professional and comparing quotes and policies will help you make an informed decision.

I Comparing quotes and policies before making a decision

Before making a decision on buying permanent life insurance, it is crucial to compare quotes and policies from different insurance providers. This allows you to evaluate the coverage options, premiums, and benefits offered by each policy. By comparing and analyzing this information, you can make an informed decision about which policy best suits your needs and financial goals. Additionally, seeking advice from an insurance professional can also help you navigate the complexities of different policies and make a well-informed choice.

II Seeking advice from an insurance professional

Seeking advice from an insurance professional can provide valuable insights and guidance when buying permanent life insurance. These professionals have extensive knowledge and experience in the insurance industry and can help you understand complex policies, identify the right coverage for your needs, and answer any questions you may have. Their expertise can ensure that you make an informed decision and choose a policy that aligns with your financial goals and objectives.