Home warranty insurance provides homeowners with coverage and protection against unexpected repairs and replacements of major home systems and appliances. This type of insurance can give homeowners peace of mind knowing that they are financially protected if something were to go wrong in their home. In this article, we will discuss the benefits of home warranty insurance, how to research and compare different providers, choosing the right coverage, applying for the insurance, reviewing terms and conditions, and making an informed decision. Whether you are a new homeowner or looking to update your current coverage, this article will guide you through the process of applying for home warranty insurance.

Keywords: home warranty insurance, coverage, repairs, replacements, major home systems, appliances, peace of mind, financial protection, research, comparison, applying, terms and conditions, informed decision

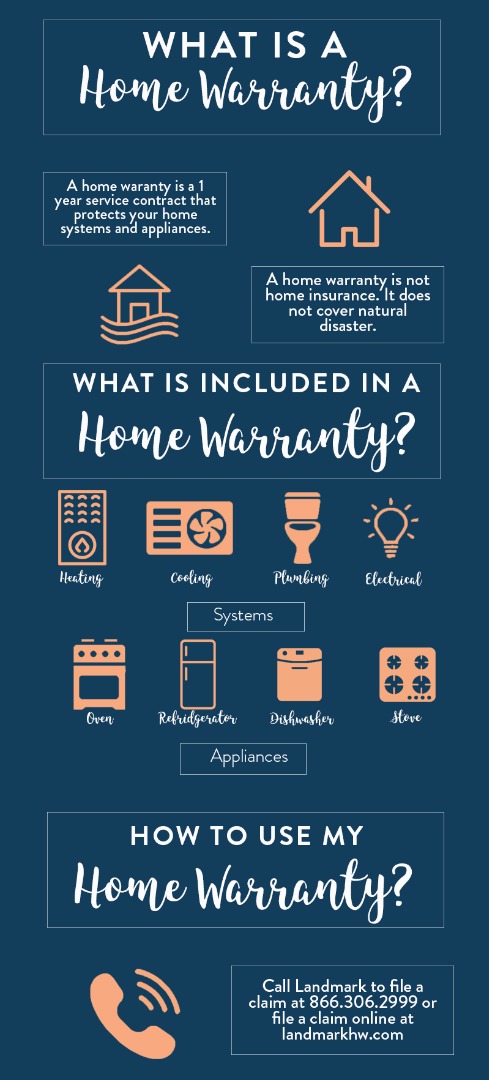

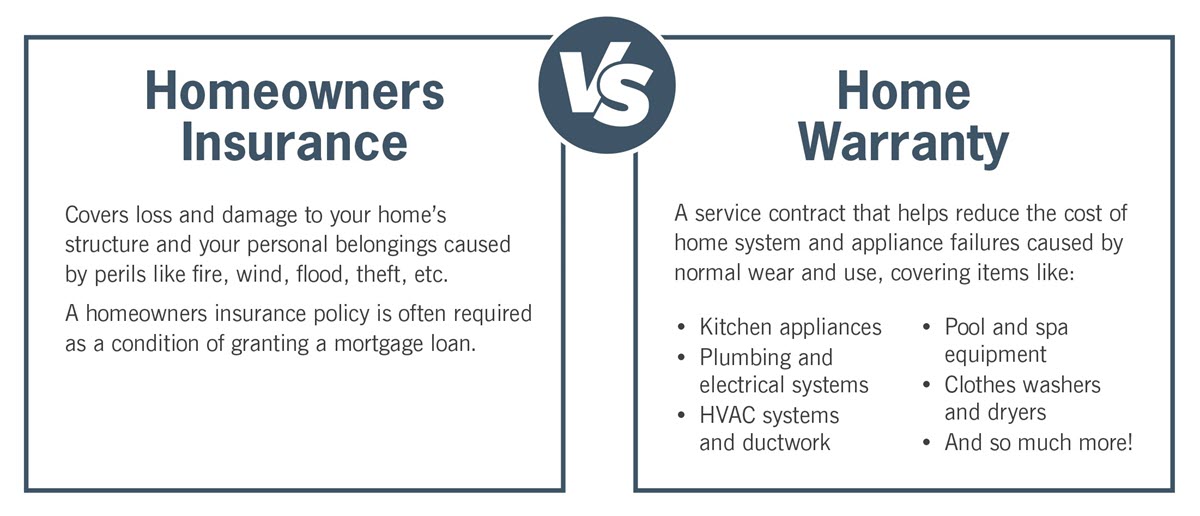

What is Home Warranty Insurance?

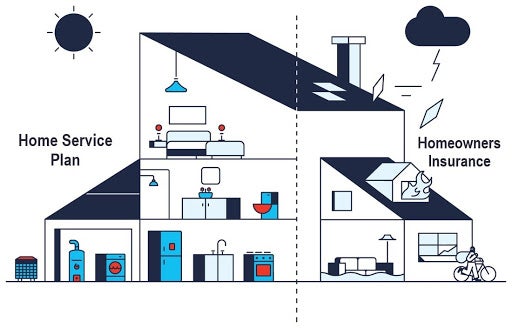

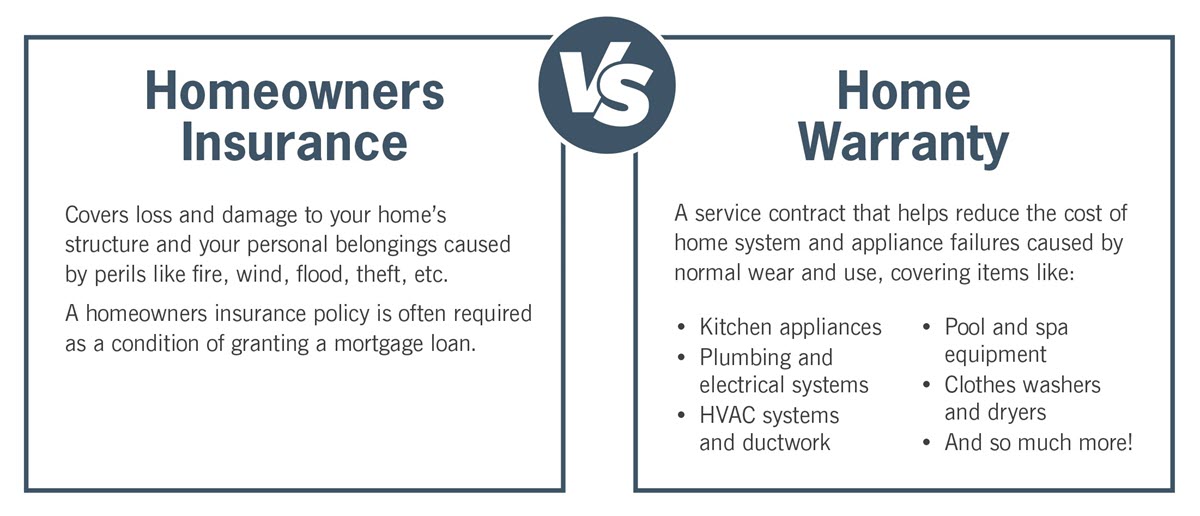

Home warranty insurance is a type of coverage that homeowners can purchase to protect themselves against unexpected repairs or replacements of major home systems and appliances. It provides financial protection and peace of mind by covering the cost of repairs or replacements due to normal wear and tear. With home warranty insurance, homeowners can rest easy knowing that they are financially safeguarded against unexpected home maintenance expenses.

Benefits of Home Warranty Insurance

Home warranty insurance offers several benefits to homeowners. It provides financial protection and peace of mind by covering the cost of repairs or replacements for major home systems and appliances. This can save homeowners from unexpected and expensive repair bills. Additionally, home warranty insurance can provide access to a network of qualified professionals, making the repair process easier and more convenient. It also helps homeowners budget for home maintenance costs and can increase the overall value of the home.

Research and Comparison

Research and comparison are essential steps when applying for home warranty insurance. Homeowners should assess their specific needs and determine which coverage options are most important to them. They should also compare different providers to find the best coverage at the most affordable price. This can be done by researching online, reading customer reviews, and obtaining quotes from multiple companies. By conducting thorough research and comparison, homeowners can make an informed decision about their home warranty insurance provider.

Assessing your home warranty needs

Assessing your home warranty needs is an important step in applying for home warranty insurance. Homeowners should consider factors such as the age and condition of their appliances and systems, their budget, and their level of maintenance and repair skills. By evaluating these factors, homeowners can determine which coverage options are most essential for their specific needs. This assessment will help them select the most suitable home warranty insurance policy.

Comparing different home warranty insurance providers

When comparing different home warranty insurance providers, homeowners should consider factors such as coverage options, pricing, customer reviews and ratings, and the provider's reputation and experience in the industry. It's important to research multiple providers and compare their offerings to ensure you choose a reputable company that offers the coverage and service that meets your needs.

Choosing the Right Coverage

When choosing the right coverage for your home warranty insurance, it's important to understand what is covered by the policy. Look for comprehensive coverage that includes major systems and appliances in your home. Additionally, consider any additional coverage options that may be beneficial to your specific needs, such as coverage for pool and spa equipment or renewable energy systems. Carefully review the coverage options and compare them across different providers to ensure you choose the policy that best suits your home and budget.

Understanding what is covered by a home warranty insurance policy

A home warranty insurance policy typically covers major systems and appliances in your home, such as HVAC systems, electrical systems, plumbing, and kitchen appliances. It provides financial protection against unexpected repair or replacement costs due to normal wear and tear. However, coverage can vary between providers, so it is important to carefully review the policy details and exclusions to ensure you have the coverage you need.

Additional coverage options to consider

When applying for home warranty insurance, it's important to consider additional coverage options that may be available. These additional options can provide added protection and peace of mind. Some common additional coverage options include coverage for well pumps, septic systems, pool and spa equipment, and even roof leaks. By understanding these additional coverage options, homeowners can tailor their policy to suit their specific needs and budget.

Applying for Home Warranty Insurance

Applying for home warranty insurance is a straightforward process. Homeowners need to gather necessary information and documents, such as property details, maintenance records, and previous warranty plans. They can apply for insurance either online or through an agent. It is essential to carefully review the terms and conditions of different providers before making a decision. This ensures that homeowners understand the coverage, exclusions, and limitations of the policy.

Gathering necessary information and documents

When applying for home warranty insurance, homeowners need to gather necessary information and documents. This typically includes property details, such as the address, size, and age of the home. It is also helpful to have maintenance records and any previous warranty plans on hand. These documents provide important information about the home and its history, which helps insurance providers assess the coverage needed for the property.

Applying online or through an agent

When applying for home warranty insurance, homeowners have the option to apply online or through an agent. Online applications offer convenience and quick processing, allowing homeowners to fill out forms and submit documents digitally. On the other hand, applying through an agent provides personalized assistance and guidance throughout the application process. Homeowners can choose the method that suits their preferences and needs.

Reviewing terms and conditions

When applying for home warranty insurance, it is crucial to carefully review the terms and conditions of the policy. Homeowners should pay attention to the policy exclusions and limitations to understand what is not covered. It is also important to evaluate the terms and conditions of different providers to ensure they offer the desired level of coverage and meet specific needs. This step is essential in making an informed decision and selecting the right home warranty insurance policy.

Understanding the policy exclusions and limitations

When reviewing the terms and conditions of a home warranty insurance policy, it is important to understand the policy exclusions and limitations. These are the specific situations and items that are not covered by the policy. Homeowners should carefully read through this section to ensure they are aware of any potential limitations or exclusions. This will help them make an informed decision about the coverage and assess whether it meets their specific needs.

Evaluating the terms and conditions of different providers

When choosing a home warranty insurance provider, it is crucial to carefully evaluate the terms and conditions of each company. Look for any limitations or exclusions that may apply to your specific needs. Pay attention to coverage limits, deductibles, and any additional fees. Consider the reputation and customer reviews of each provider to ensure their policies are reliable and trustworthy. By thoroughly reviewing and comparing the terms and conditions, homeowners can make an informed decision that best suits their requirements.

Conclusion

In conclusion, applying for home warranty insurance requires thorough research and comparison of different providers. Homeowners should understand their coverage needs and carefully review the terms and conditions of each company. By gathering necessary information and evaluating policy exclusions, homeowners can make an informed decision. It is important to choose a reliable provider that offers comprehensive coverage and meets the specific needs of the homeowner.

Making an informed decision

When it comes to applying for home warranty insurance, making an informed decision is crucial. Homeowners should carefully evaluate their needs, compare different providers, and review the terms and conditions. By gathering all the necessary information and understanding the coverage options, homeowners can choose a reliable provider that offers comprehensive coverage and meets their specific needs. Taking the time to research and compare will ensure a well-informed decision is made.

FAQs about home warranty insurance

Q: What is home warranty insurance?

A: Home warranty insurance is a service contract that covers the repair or replacement of major home systems and appliances due to normal wear and tear. It provides homeowners with financial protection against unexpected expenses and offers peace of mind knowing that their home is protected.

Q: What does home warranty insurance cover?

A: Home warranty insurance typically covers the repair or replacement of systems and appliances such as HVAC, electrical, plumbing, kitchen appliances, and more. However, coverage can vary between providers, so it is important to review the policy details and understand what is included in the coverage.

Q: Can I choose my own service provider with home warranty insurance?

A: Some home warranty insurance providers allow homeowners to choose their own service providers, while others have a network of pre-approved contractors. It is important to check the policy terms to understand the provider's policy regarding service providers and whether there are any restrictions or limitations.

Q: How much does home warranty insurance cost?

A: The cost of home warranty insurance can vary depending on factors such as the size of the home, the coverage options chosen, and the provider. It is recommended to obtain quotes from different providers and compare the costs and coverage options to make an informed decision.

Q: Is home warranty insurance worth it?

A: Home warranty insurance can be worth it for homeowners who want to protect themselves against the high costs of unexpected repairs and replacements. However, it may not be necessary for everyone. It is important to assess your specific needs, evaluate the costs and benefits, and determine if the coverage aligns with your situation.

Q: How long does home warranty insurance coverage last?

A: The duration of home warranty insurance coverage can vary between providers. Some policies offer coverage for a specific period, such as one year, while others provide continuous coverage as long as the policy is renewed. It is important to review the policy terms to understand the duration of coverage.

Q: Can I purchase home warranty insurance at any time?

A: Homeowners can generally purchase home warranty insurance at any time, whether they are buying a new home or have been living in their home for years. However, some providers may have certain eligibility requirements or restrictions. It is recommended to contact the provider directly to inquire about the application process and any specific conditions.

Q: Can I cancel my home warranty insurance policy?

A: Home warranty insurance policies may have cancellation policies and fees. It is important to review the terms and conditions of the policy to understand the cancellation process and any associated costs. If you are considering cancelling your policy, it is recommended to contact the provider directly to discuss your options and any potential refunds.