Introduction to Health Insurance

Health insurance is a form of coverage that helps individuals and families pay for their medical expenses. It provides financial protection by reimbursing policyholders for expenses incurred due to illness, injury, or preventive care. Health insurance is vital in ensuring that individuals have access to quality healthcare without facing exorbitant costs. It offers peace of mind, knowing that medical expenses will be covered, thus promoting overall well-being.

Definition and Purpose of Health Insurance

Health insurance is a form of coverage that helps individuals and families pay for their medical expenses. It provides financial protection by reimbursing policyholders for expenses incurred due to illness, injury, or preventive care. The purpose of health insurance is to ensure that individuals have access to quality healthcare without facing exorbitant costs. It offers peace of mind, knowing that medical expenses will be covered, thus promoting overall well-being.

Importance of Having Health Insurance Coverage

Having health insurance coverage is of utmost importance as it provides individuals and families with financial protection against unexpected medical expenses. It ensures that they have access to quality healthcare without the fear of exorbitant costs. Health insurance offers peace of mind, promotes preventive care, and allows individuals to seek timely medical treatment, thus contributing to their overall well-being.

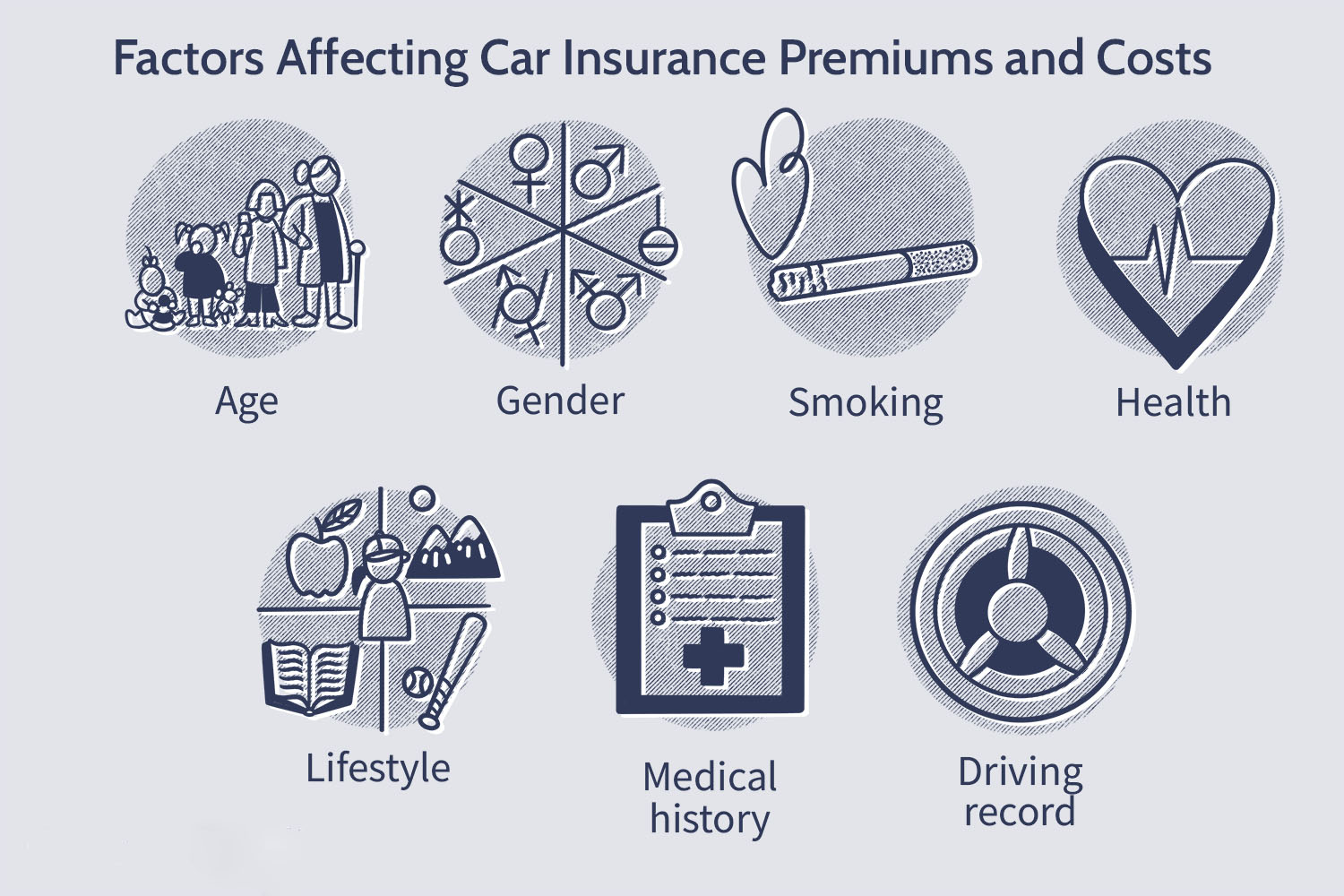

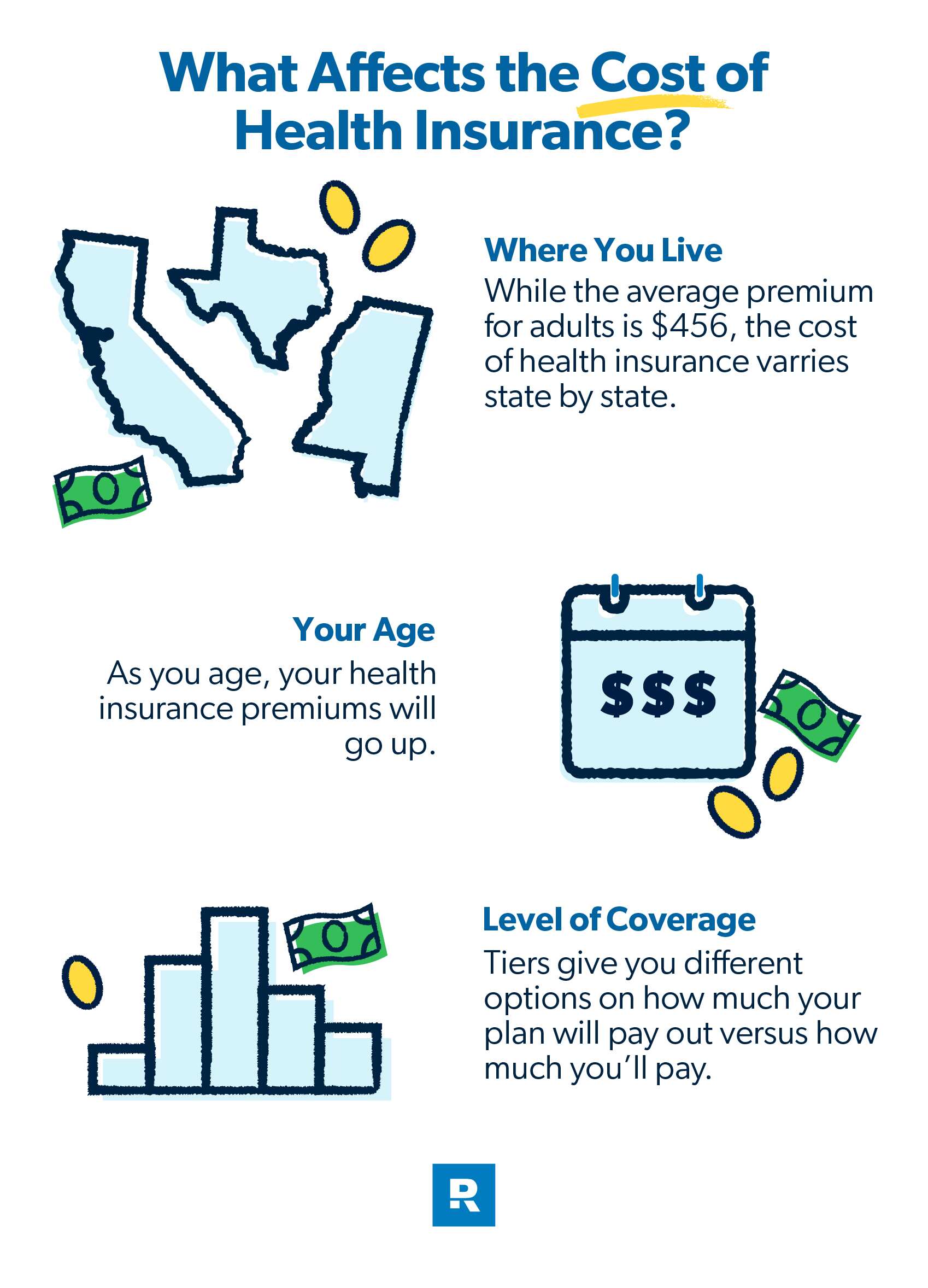

Factors Affecting Health Insurance Costs

Several factors can influence health insurance costs. Two key factors are age and location. Older individuals generally have higher premiums due to increased health risks and potential for more frequent medical care. Additionally, insurance rates can vary based on location due to differences in healthcare costs and access to healthcare services. It is important to consider these factors when selecting a health insurance plan to ensure affordability and suitability.

Age

Age is a significant factor that affects health insurance costs. As individuals get older, they are more likely to require medical care and treatments, resulting in higher premiums. Insurance companies consider age as a risk factor due to the increased likelihood of chronic diseases. Older individuals may also need more frequent doctor visits, medications, and specialized treatments, leading to higher healthcare expenses. Therefore, age plays an important role in determining health insurance costs.

Location

Location is another factor that can impact health insurance costs. The cost of healthcare services can vary significantly depending on where you live. Areas with higher costs of living tend to have higher health insurance premiums. Additionally, certain states may have different regulations and requirements for health insurance coverage, which can also affect the cost. It's important to consider the location when determining health insurance costs and to research and compare options in your specific area.

Types of Health Insurance Plans

Health insurance plans can be categorized into two main types: individual and family plans, and employer-sponsored plans.

Individual and family plans are purchased directly by individuals or families to provide coverage for medical expenses. These plans offer a range of options and coverage levels to meet different needs and budgets.

On the other hand, employer-sponsored plans are offered by employers to their employees as part of their employee benefits package. These plans are often more comprehensive and may provide additional benefits such as dental and vision coverage.

Both types of plans have their own advantages and considerations, and individuals should carefully evaluate their needs and options to determine which type of plan is the best fit for their healthcare needs and budget.

Individual and Family Plans

Individual and family plans are health insurance options that can be purchased directly by individuals and families. These plans offer coverage for medical expenses and can be tailored to meet specific needs and budgets. They provide flexibility in choosing healthcare providers and offer a range of coverage levels. Individual and family plans are a popular choice for those who do not have access to employer-sponsored insurance or who prefer to have more control over their healthcare options.

Employer-Sponsored Plans

Employer-sponsored plans are health insurance plans that are provided by an employer to their employees. These plans are typically more affordable than individual plans and often offer more comprehensive coverage. The cost of the plan is shared between the employer and the employee, with the employer typically paying a larger portion. Employer-sponsored plans are a common benefit offered by companies to attract and retain employees. They provide a convenient way for individuals to obtain health insurance coverage through their workplace.

Determining the Cost of Health Insurance

Determining the cost of health insurance involves considering several factors. Premiums, which are the monthly payments for the insurance, are based on factors such as age, location, and plan type. Deductibles and copayments are additional costs that individuals have to pay out-of-pocket when receiving medical services. These costs can vary depending on the plan. It is important to carefully review and compare different insurance plans to find the best coverage at an affordable cost.

Premiums

Premiums are the monthly payments individuals make for their health insurance coverage. The cost of premiums is influenced by several factors, including age, location, and plan type. Younger individuals generally have lower premiums compared to older individuals. The location also plays a role, as healthcare costs can vary depending on the region. Additionally, the type of plan selected, such as a basic plan or a more comprehensive plan, can affect the premium amount. It is important to carefully consider these factors when choosing a health insurance plan to find the most affordable option for individual needs.

Deductibles and Copayments

Deductibles and copayments are additional costs that individuals may have to pay when using their health insurance. A deductible is the amount that a person must pay out-of-pocket before their insurance coverage kicks in. Copayments, on the other hand, are fixed amounts that individuals pay for specific healthcare services, such as doctor visits or prescription medications. These costs can vary depending on the specific health insurance plan and can significantly affect overall healthcare expenses.

Ways to Save on Health Insurance

There are several ways individuals can save on health insurance costs. One option is to take advantage of government subsidies or tax credits that may be available based on income level. Another option is to utilize a Health Savings Account (HSA) which offers tax-free savings for medical expenses. Comparing different health insurance plans and shopping around for the best rates can also help individuals find affordable coverage. It is important to carefully consider the benefits and coverage offered by each plan to ensure the best value for money.

Government Subsidies

Government subsidies are a valuable resource for individuals looking to save on health insurance costs. These subsidies, typically provided through programs like the Affordable Care Act, are based on income level and can help lower monthly premiums. By qualifying for these subsidies, individuals can access more affordable health insurance options that fit their budget. It is important to research and determine eligibility for these subsidies to effectively save on health insurance expenses.

Health Savings Accounts

Health Savings Accounts, or HSAs, are another way to save on health insurance costs. HSAs are tax-advantaged accounts that individuals can contribute to and use for qualified medical expenses. The funds in an HSA can be used to pay for deductibles, copayments, and other out-of-pocket healthcare expenses. By utilizing an HSA, individuals can save money on healthcare costs and potentially reduce their taxable income.

Conclusion

In conclusion, having health insurance is crucial for individuals and families to protect themselves from financial burdens associated with healthcare expenses. The cost of health insurance varies based on factors such as age and location. It is important to compare different health insurance plans and consider ways to save, such as government subsidies and health savings accounts. Investing in health insurance provides peace of mind and ensures access to necessary medical care. It is essential for individuals to carefully consider their options and choose a plan that meets their healthcare needs and budget.

Importance of Investing in Health Insurance

:max_bytes(150000):strip_icc()/Are-health-insurance-premiums-tax-deductible-4773286_v1-dbe23582da6346498c4596ab0bfa05f2.jpg)

Investing in health insurance is vital for individuals and families to protect themselves from the high costs of medical care. It provides financial security and peace of mind, ensuring access to necessary healthcare services without worrying about the expenses. Health insurance not only covers routine check-ups but also major medical treatments, surgeries, and prescription medications. It serves as a safety net during unforeseen medical emergencies and helps individuals maintain their overall well-being. It is an investment in one's health and financial stability.

Final Thoughts and Considerations

In conclusion, investing in health insurance is a crucial decision for individuals and families. The high costs of medical care can be financially devastating without proper coverage. By having health insurance, individuals can have peace of mind, knowing they have access to necessary healthcare services when needed. It is important to carefully consider the options available, assess personal healthcare needs, and choose a plan that provides adequate coverage at an affordable cost. Remember, health insurance is an investment in both health and financial stability.